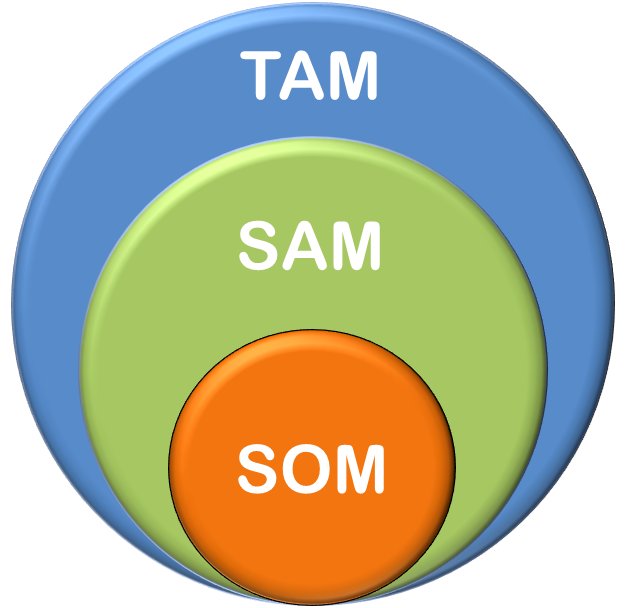

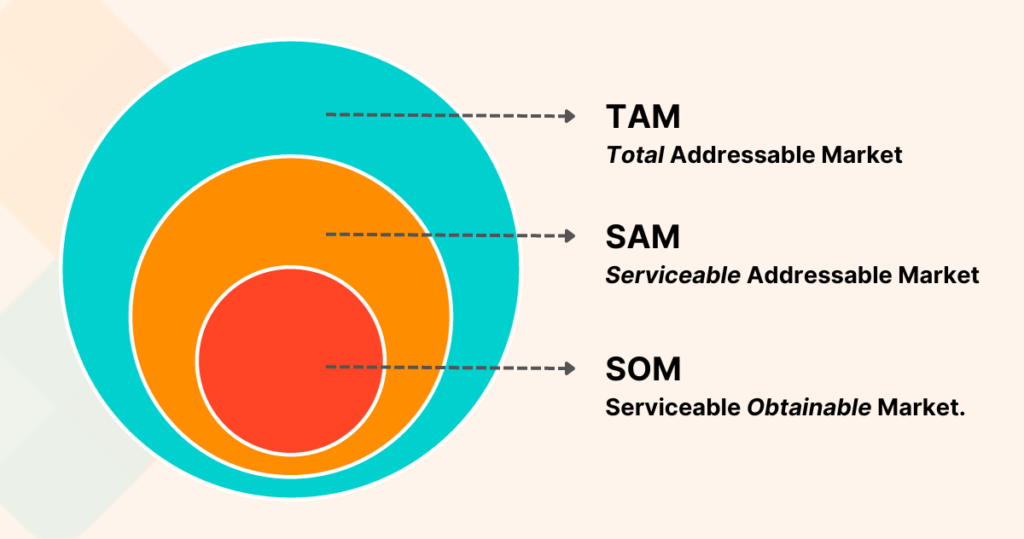

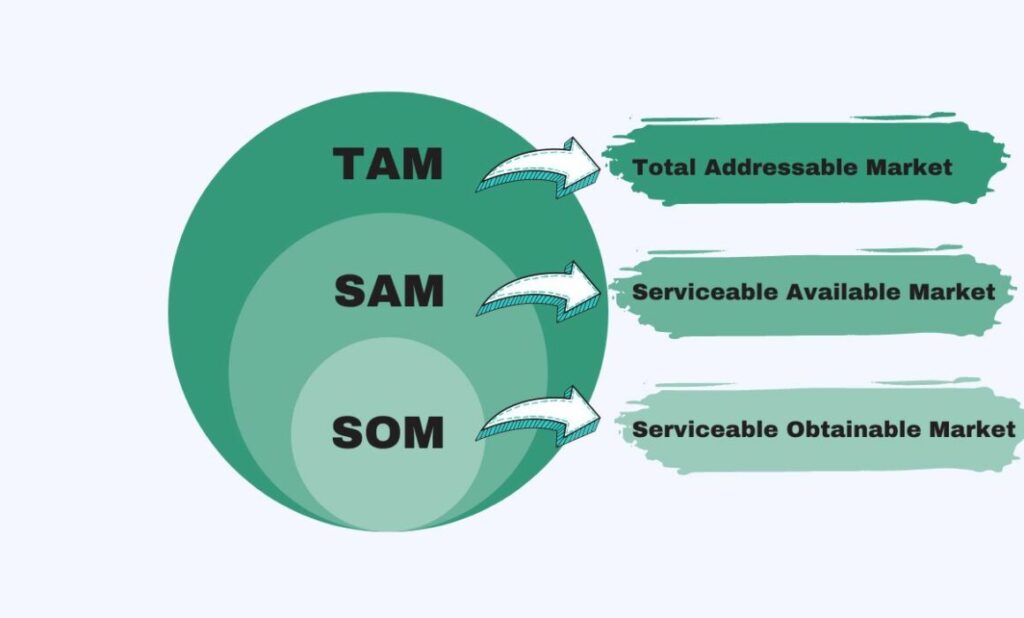

When you’re starting a business, there are a lot of moving pieces, and one critical component is understanding your market size. Knowing how big your market is and how much you can realistically capture is vital for everything from planning to attracting investors. Enter TAM, SAM, and SOM—three acronyms that can help you navigate this landscape like a pro. Let’s break them down.

What is TAM, SAM, and SOM?

TAM, SAM, and SOM might sound like marketing jargon, but they’re essential concepts that can make or break your business strategy. These terms refer to different levels of your potential market, and understanding them can help you focus your resources effectively.

TAM (Total Addressable Market) Explained

TAM represents the total demand for your product or service. It’s the big picture—the complete market for your offering, assuming there are no competitors and your product can serve everyone.

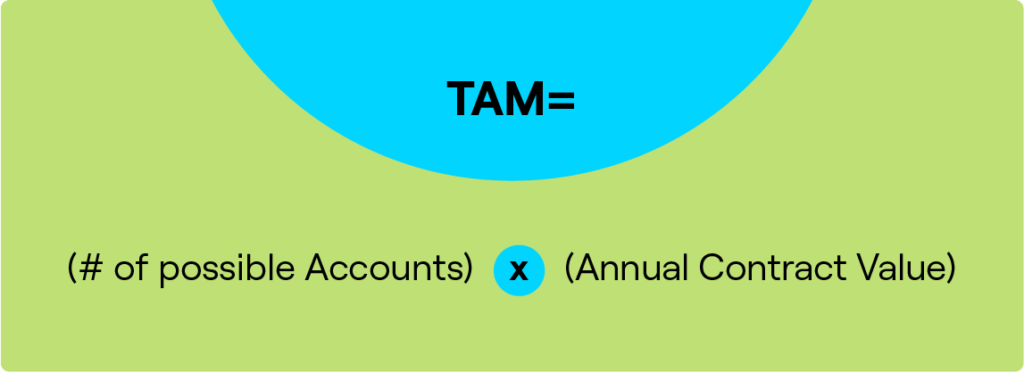

How to Calculate TAM

To calculate TAM, you start by determining the number of potential customers interested in your product. Multiply that by the average revenue per customer to get a rough estimate of your TAM. For instance, if you’re selling a software tool for graphic designers and there are 1 million potential users worldwide who might pay $100 a year, your TAM is $100 million.

Importance of TAM for Business Strategies

Knowing your TAM gives you a sense of your market’s maximum growth potential. It’s essential for determining whether your business idea is scalable. If your TAM is too small, your business might not grow enough to meet your financial goals.

SAM (Serviceable Available Market) Overview

SAM narrows things down a bit. This is the portion of the TAM that your product can serve, considering factors like geography, technical limitations, and legal barriers. SAM gives you a more realistic sense of your market’s size.

Distinguishing SAM from TAM

The key difference between TAM and SAM is that SAM factors in your business’s practical limitations. For example, if your product is only available in North America, your SAM would be the North American market rather than the global market.

Critical Considerations in SAM Calculation

When calculating SAM, consider factors like your target geography, your market’s specific needs, and whether your product can meet those needs. This can involve conducting market research or analysing industry trends to understand your reach better.

SOM (Serviceable Obtainable Market) Defined

Finally, SOM is your slice of the pie. It’s the segment of the SAM that you can realistically capture, given your competition and resources. This is where the rubber meets the road. SOM helps you figure out what portion of the market you can dominate.

The Role of SOM in Targeting Market Share

SOM is critical because it tells you how much of the market you can realistically expect to take. This is based on your current sales capabilities, marketing budget, and competition. SOM helps set the right expectations when forecasting revenue.

Factors Influencing SOM Estimation

Several elements affect your SOM, including the strength of your competitors, customer loyalty, and how well your product fits the market’s needs. Understanding these factors helps create a more accurate SOM estimate.

Why TAM, SAM, and SOM Matter for Startups

Now that you know what TAM, SAM, and SOM are, why do they matter for startups? These metrics are more than just numbers—they’re the foundation of your business strategy.

Strategic Decision-Making

Understanding TAM, SAM, and SOM helps you make better strategic decisions. If you know your TAM is huge, but your SOM is tiny, you might need to rethink your approach or allocate resources differently to grow your market share.

Attracting Investors

Investors love seeing TAM, SAM, and SOM because they give them a clear picture of your market potential. A large TAM can attract attention, but a well-defined SOM shows investors that you have a realistic plan to capture part of that market.

Identifying Growth Potential

These metrics also help you pinpoint growth opportunities. If your SOM is tiny but your SAM is relatively large, you have room to expand, perhaps by investing more in marketing or improving your product’s features.

Practical Steps to Estimate TAM, SAM, and SOM

Establishing accurate TAM, SAM, and SOM estimates requires research and a good understanding of your market. Here are a few practical steps to get started.

Research Market Data

Use industry reports, census data, and surveys to understand your potential customer base clearly. Market data will help you estimate TAM by identifying the total demand for your product.

Conduct Surveys and Customer Interviews

Direct feedback from potential customers is gold. Conduct surveys and interviews to understand better who would buy your product, how much they would pay, and any barriers they might face.

Use Industry Benchmarks

If you’re entering a well-established industry, you can use benchmarks from similar companies to estimate your SAM and SOM. This involves examining competitors’ market share to gauge what’s achievable for you.

Common Mistakes to Avoid When Calculating TAM, SAM, SOM

It’s easy to make mistakes when estimating market sizes, especially if you’re too optimistic or neglect critical details. Here are a few pitfalls to watch out for.

Overestimating the Market Size

It’s tempting to assume everyone will buy your product, but that’s rarely true. Be realistic about the limitations and consider factors like customer preferences, regional differences, and economic conditions.

Ignoring Customer Segmentation

Not all customers are the same. Segment your market effectively to get a better estimate of your SAM and SOM. Ignoring customer segmentation can lead to inflated numbers and misguided strategies.

Failing to Adapt to Market Changes

Markets evolve, and your TAM, SAM, and SOM estimates should adapt accordingly. Whether it’s new competitors or changing consumer needs, stay updated and adjust your calculations.

Tools and Resources for Accurate Calculation

Calculating TAM, SAM, and SOM doesn’t have to be guesswork. Several tools can help make the process easier.

Market Research Platforms

Platforms like Statista, Gartner, and IBISWorld offer extensive market research reports that can give you valuable insights and data for estimating your TAM and SAM.

Competitive Analysis Tools

Use tools like SimilarWeb or SEMrush to analyse competitor data and see what market portion they’re capturing. This can give you a clearer sense of your SOM.

Conclusion

TAM, SAM, and SOM are potent tools for startups to understand their market potential and carve out a successful path. These concepts aren’t just academic; they provide a roadmap to guide your strategic decisions, attract investors, and grow your business sustainably. You can tackle your market confidently by thoroughly researching and accurately calculating these metrics.