Starting a business is an exhilarating journey filled with opportunities and challenges. From the moment entrepreneurs conceive a groundbreaking idea, they embark on a path that requires both vision and the resources to bring that vision to life. One of the most critical aspects for early-stage startups is securing adequate funding, as financial support is vital for transforming concepts into reality. Pre-seed funding is the crucial first step in this process, providing the essential capital needed to develop innovative ideas into viable business ventures.

At this initial stage, founders often seek financial backing from family, friends, or angel investors who believe in their potential. This funding enables them to cover preliminary costs such as market research, product development, and establishing a business model. In this guide, we delve deep into the nuances of pre-seed funding, exploring its importance in the startup ecosystem, the various processes involved in securing it, and the practical strategies entrepreneurs can employ to attract potential investors. By understanding the intricacies of pre-seed funding, startups can position themselves for growth and set a strong foundation for future funding rounds.

What is Pre-Seed Funding?

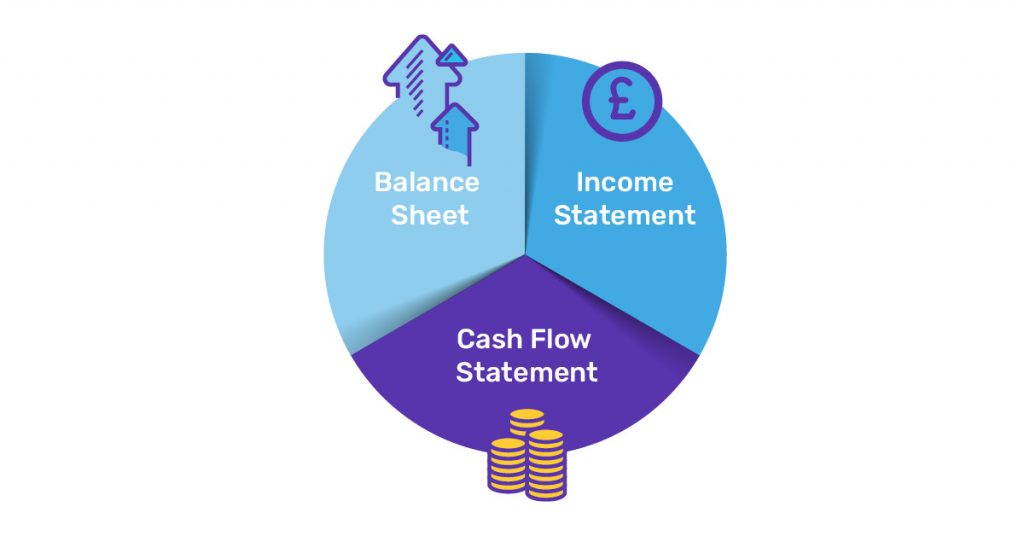

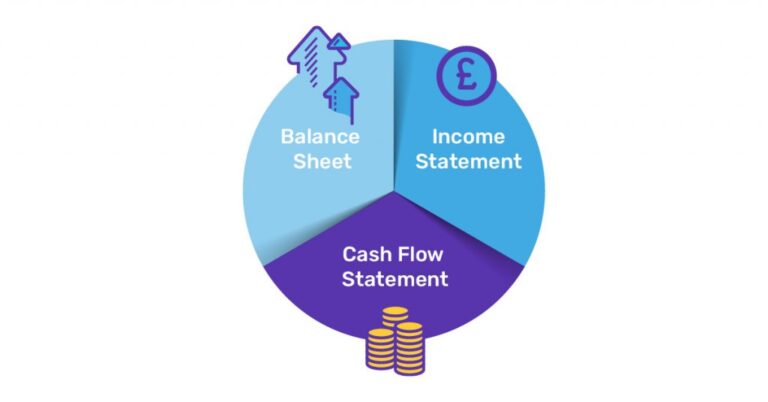

Pre-seed funding is the initial capital investment made by angel investors, friends, family, or venture capitalists before a startup officially launches its product or service. This funding is pivotal for startups in the ideation phase, allowing them to develop their ideas, create prototypes, and build their teams. Typically, pre-seed funding amounts range from $50,000 to $250,000, enabling entrepreneurs to validate their concepts without relinquishing significant equity.

Pre-Seed vs. Seed Funding: Key Differences

Understanding the distinction between pre-seed and seed funding is essential for entrepreneurs navigating their financing journey.

Aspect | Pre-Seed Funding | Seed Funding |

Stage | Earliest funding stage | Follows pre-seed funding |

Purpose | Develop business ideas and create MVPs | Scale the business and enter the market |

Funding Amount | Typically $50,000 – $250,000 | Generally more significant, from hundreds of thousands to millions |

Investors | Angel investors, friends, family | Venture capital firms, angel investors |

Importance of Pre-Seed Funding for Startups

1. Launching Your Business

Pre-seed funding provides the financial lifeline necessary to launch a startup. In the early stages, traditional funding sources may hesitate to invest due to the lack of proven viability. Pre-seed funding bridges this gap, enabling entrepreneurs to turn their ideas into tangible products.

2. Building Valuable Connections

Many pre-seed investors are seasoned entrepreneurs who offer capital, mentorship, and guidance. This support can prove invaluable, helping startups navigate common pitfalls and make informed decisions during their formative years.

3. Retaining Control

Since pre-seed funding typically involves smaller amounts of capital, it often comes with fewer strings attached than later funding rounds. This allows entrepreneurs to maintain greater control over their vision and business direction.

Stages in the Pre-Seed Funding Process

Navigating the pre-seed funding landscape requires a systematic approach:

1. Developing Your Business Idea

Conduct thorough market research and create a robust business plan. Identify your target audience and refine your value proposition.

2. Building a Strong Team

Assemble a capable team with diverse skills—engineers, designers, and marketers are vital to transforming your idea into a viable product.

3. Creating a Pitch Deck

Craft a compelling pitch deck that outlines your business model, market research, and financial projections. Tailor it specifically for pre-seed investors to highlight how their funds will facilitate growth.

4. Identifying Potential Investors

Leverage personal networks, online platforms, and industry events to connect with potential pre-seed investors who share an interest in your business sector.

5. Pitching Your Idea

Prepare for pitching your business idea through direct meetings, emails, or crowdfunding campaigns. Be ready to articulate your vision, business model, and how the funding will be utilised.

6. Negotiating Terms

If an investor shows interest, be prepared to negotiate the funding amount, equity stakes, and other terms associated with the investment.

7. Closing the Deal

Finalising the investment involves signing legal documents and transferring funds. Ensure all terms are clearly outlined and agreed upon.

8. Utilizing Funds Wisely

Once funding is secured, allocate resources efficiently—focus on product development, team building, and marketing efforts to prepare for the next funding round.

When to Start Raising Pre-Seed Funding

Timing is critical when seeking pre-seed funding. Entrepreneurs should consider raising funds after the following:

- Validating their concept through market research.

- Building an initial proof of concept.

- Assembling a skilled founding team.

- Identifying their target market and potential revenue streams.

These steps will enhance credibility with investors and increase the likelihood of securing funding.

Identifying Potential Pre-Seed Investors

To attract pre-seed investors, entrepreneurs can explore various channels:

Networking

Utilise personal and professional networks to seek introductions to potential investors. Personal connections often yield valuable leads.

Online Platforms

Platforms like Seedrs and Crowdcube connect entrepreneurs with investors. Create a compelling profile to attract interest.

Industry Events

Attend conferences and events related to your sector to network with investors and gain insights into market trends.

Startup Organizations

Engage with incubators and accelerators that offer mentorship and have established networks of potential investors.

Critical Considerations for Securing Pre-Seed Funding

1. Developing a Solid Business Plan

A well-articulated business plan is essential. It should outline your mission, market analysis, revenue model, and growth strategy and showcase a clear vision for success.

2. Demonstrating Market Validation

Provide evidence of demand for your product or service through surveys, focus groups, or early user feedback. This validation instils confidence in potential investors.

3. Crafting a Compelling Pitch

Your pitch must succinctly convey the problem your startup solves, the unique value it offers, and your strategic growth plan. A well-designed pitch deck is crucial in making a solid impression.

4. Building Relationships

Cultivating relationships with potential investors before formal pitches can create trust and facilitate a smoother funding process.

5. Understanding What Investors Seek

Investors typically look for a solid founding team, a clear value proposition, evidence of market demand, a scalable business model, and the ability to adapt based on feedback.

Conclusion: Making Pre-Seed Funding Work for Your Startup

Pre-seed funding is essential for startups seeking to turn their visions into reality. By understanding the intricacies of this funding stage, preparing diligently, and effectively communicating your business potential, you can secure the investment needed to propel your startup forward. Through careful planning and execution, pre-seed funding can lay the foundation for future growth and success.