In the world of startups, financial modelling is not merely a numerical exercise; it’s a critical storytelling tool that can define the future of your business. When you present your startup to potential investors, your financial model serves as more than just a spreadsheet—it’s a narrative that conveys your company’s potential, viability, and strategic direction. A meticulously crafted financial model is not just essential for illustrating your startup’s value proposition, guiding negotiations, and securing the investment you need to grow, but it also holds the promise of significant rewards and growth opportunities.

In today’s challenging investment climate, where venture capital (VC) is not as readily available as it was in the boom years of 2021, having a robust financial model is more important than ever. According to Crunchbase, even the surge in funding for AI startups in the second quarter of 2023 wasn’t enough to revive global VC investment levels. This environment demands that startups present themselves as low-risk, high-reward opportunities with financial models that demonstrate their potential.

Viewing Financial Models Through the Investor's Lens

As a startup consultant, I specialise in mergers and acquisitions (M&A) advisory, fundraising strategy, pitch deck creation, financial modelling, and valuation analysis. Over the years, many startup founders have overlooked one fundamental principle: crafting financial models that resonate with investors. This oversight can be costly, as investors are intensely focused on financials. They often spend more time scrutinising this section of a pitch deck than any other, save for the fundraising ask itself.

It might be tempting for founders, especially those with limited financial expertise, to rely on pre-designed financial model templates. However, these templates can be more of a hindrance than a help. They often include irrelevant sections or complex embedded formulas that are difficult to customise. The result is a model that doesn’t fit your business and fails to communicate the necessary information effectively. Instead, building a financial model from scratch, tailored to your startup’s unique needs, can yield a more professional and persuasive tool.

Prioritising Key Performance Indicators (KPIs)

One of the most crucial aspects of financial modelling is striking the right balance between providing a comprehensive overview and avoiding information overload. This is where key performance indicators (KPIs) come into play. KPIs are the metrics that best illustrate your startup’s health and growth potential. It’s essential to prioritise these metrics to ensure that investors can quickly understand your business’s strengths.

For example, I once assisted an e-commerce startup that had developed an overly detailed financial model. The model was so intricate that it obscured the critical KPIs, making it difficult for investors to discern the company’s true potential. By refocusing the model on the most relevant KPIs—such as customer acquisition cost (CAC), lifetime value (LTV), and monthly active users (MAUs)—we were able to create a more transparent and compelling presentation.

Understanding Your Business and Industry

To effectively identify the right KPIs, you must first have a deep understanding of your business model and the dynamics of your industry. This knowledge helps you pinpoint the metrics that investors are likely to prioritise. For instance, a Software as a Service (SaaS) company might focus on monthly recurring revenue (MRR) and customer churn rate. At the same time, a retail business might emphasise metrics like average transaction value and inventory turnover.

Aligning KPIs with Strategic Goals

It’s also crucial that your KPIs align with your startup’s strategic objectives. If your primary goal is rapid customer acquisition, your KPIs should reflect this, focusing on metrics like new customer growth and CAC. This strategic alignment ensures that your financial model is not just a collection of numbers, but a powerful tool that guides your business decisions and keeps you on course. The e-commerce startup I worked with needed to understand its break-even sales target and how this translated into customer acquisition goals across different channels. We developed a dashboard that tracked these metrics, ensuring the startup remained on course.

Making KPIs Clear and Accessible

Your financial model should present KPIs in a way that is easy for investors to find and understand. This can be achieved by creating a dedicated KPI dashboard or a visually appealing tab within your financial model, using charts, graphs, and tables to highlight these critical metrics. For the e-commerce startup, we created such a dashboard, which made it significantly easier for investors to grasp the company’s performance and potential at a glance. This clear presentation was instrumental in securing the desired funding, with investors specifically citing the transparency and clarity of the KPIs as a critical factor in their decision.

Integrating the Capitalisation Table (Cap Table)

Another vital element of a compelling financial model is the incorporation of your startup’s capitalisation (cap) table. The cap table provides a snapshot of your company’s ownership structure, detailing founder equity, investor equity, employee stock options, convertible securities, and potential dilution scenarios. Ensuring that your financial model and cap table are consistent and aligned offers investors a comprehensive view of your startup’s financial and ownership structures, enhancing their confidence in your business.

Creating a Sense of Urgency

A well-crafted financial model can also be a powerful tool for creating a sense of urgency among investors. Highlighting time-sensitive opportunities, market trends, and the consequences of inaction can compel investors to act quickly. For example, I once worked with a company that had developed an AI-driven healthcare solution. By showcasing the financial potential of a new government initiative in telehealth, which had a limited application window, the company created a compelling case for immediate investment.

Formatting Your Financial Model for Maximum Impact

Once you have the content of your financial model, it’s time to focus on the presentation. The clarity and organisation of your model can significantly influence how investors perceive it. Here are some best practices:

- Separate Major Components: Organize your financial data into individual tabs for assumptions, income statements, balance sheets, cash flow statements, scenario planning, and cap tables.

- Avoid Clutter: Consolidate views and analyses where possible to avoid overwhelming tabs. For example, use one tab per financial statement, with options to toggle between different scenarios.

- Differentiate Content: Use clear headings, colour coding, and formatting to distinguish between different types of information. For instance, use bold for headings, various colours for inputs and outputs, and italics for comments or notes.

- Maintain Consistency: Ensure formatting is consistent throughout the model, with all headers, subheads, inputs, and outputs styled uniformly. This makes the model easier to navigate and understand.

- Develop Visual Aids: Use charts, graphs, and tables to represent critical data visually. These aids can help investors quickly grasp essential information, making your presentation more engaging.

The impact of a good presentation must be balanced. I once helped a SaaS company with a strong product and pitch deck but a confusing financial model. By applying consistent formatting and organising the data more effectively, we made the model easier for founders and investors to use and understand. This clarity ultimately helped the company secure the necessary funding.

Continuously Testing and Refining Your Financial Model

A financial model is not a static document; it should be regularly tested, refined, and updated to reflect your startup’s evolving business environment. This ongoing process demonstrates your commitment to understanding and managing your company’s financial health, increasing your credibility with investors.

Double-Check Assumptions and Inputs

Ensure all assumptions and inputs are based on solid data and market research. To ensure accuracy, validate your calculations and projections using industry benchmarks or historical data.

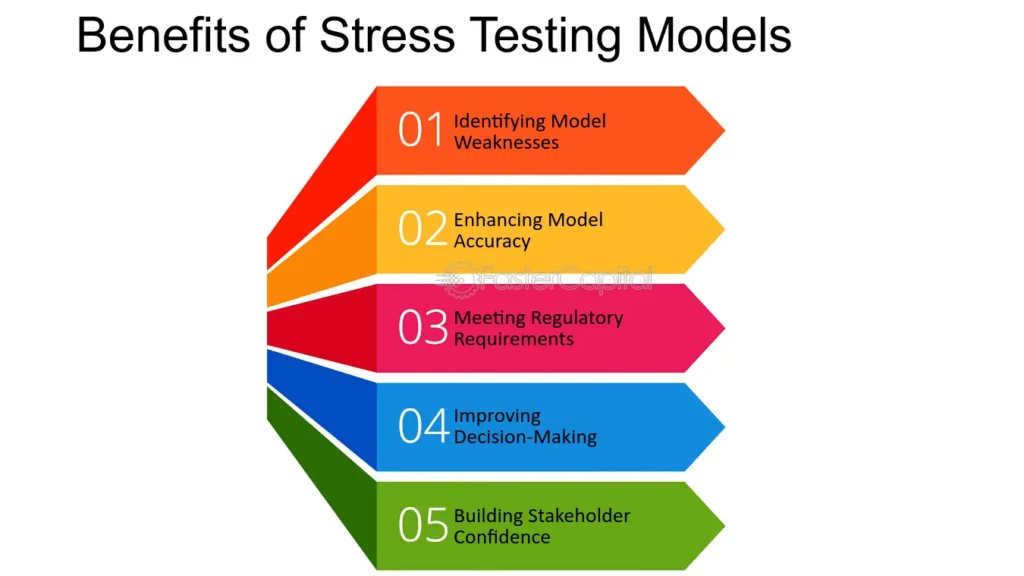

Stress-Test, Your Model

Conduct sensitivity analyses by altering key variables and assumptions to assess how these changes affect your outcomes. This helps you understand potential risks and prepares you to address investor concerns.

Seek Expert Feedback

Share your financial model with trusted advisors, mentors, or peers with fundraising experience. They can provide valuable feedback, helping you identify weaknesses and areas for improvement.

Regular Updates

As your business grows and market conditions change, regularly update your financial model with new data and revised assumptions. This ensures your model remains accurate and relevant.

Being Prepared to Defend Your Financial Model

Investors want to know that you understand your business inside and out. To instil confidence, be prepared to explain and defend every aspect of your financial model, from your assumptions and methodology to your projections. This requires a deep familiarity with the numbers and the ability to articulate your reasoning clearly and convincingly.

Understand and Explain Your Assumptions

Be ready to explain where your assumptions come from, whether based on industry research, historical data, or other reliable sources.

Articulate Your Methodology

Transparency in how you arrive at your numbers builds trust with investors. Clearly articulate your process and the reasoning behind your projections.

Anticipate Investor Questions

Prepare for common investor questions related to your model, such as how you manage customer acquisition, scale operations, or mitigate risks. Practising your responses will help you handle these inquiries with confidence.

Conclusion

A well-crafted financial model is more than just a tool for internal planning; it is a crucial component of your pitch to investors. By focusing on key metrics, ensuring clarity and consistency, and continuously refining your model, you can effectively communicate your startup’s potential and secure the funding needed to grow. Remember, your financial model is not just a collection of numbers—it’s the foundation of your business’s story. Ensure it’s one that investors will want to be a part of.