When raising investment for your startup, one of the most critical skills you can develop is the ability to sell—not just your product but your vision, your team, and ultimately yourself. Investors are buying into more than just an idea; they’re buying into your ability to execute it. Let’s dive into why mastering sales is critical to raising investment and how you can sharpen this essential skill.

Why Being Good at Sales Is Crucial for Fundraising

Sales and fundraising may seem like two different worlds, but they are actually tightly intertwined. The core principles of sales—building trust, understanding your audience, and persuading people to take action—apply directly to fundraising. A good salesperson lets you communicate your value proposition clearly, negotiate effectively, and close the deal with investors.

Understanding Investor Psychology

To master raising funds, you must understand what motivates investors. What are their priorities? What concerns do they have? Understanding their psychology can tailor your approach to meet their expectations.

What Do Investors Want?

Investors often look for a profitable opportunity, a competent and passionate team, and risk mitigation. They want to know how you’ll scale, how quickly they’ll see a return, and why you’re the team to make it happen. Addressing these points head-on builds confidence.

The Importance of Building Relationships

Sales and fundraising are built on relationships. Investors rarely commit after one meeting. You need to foster long-term relationships, provide value, and communicate regularly. Building rapport is critical to ensuring an investor sees you as a partner rather than just another pitch.

How to Present Your Startup Like a Salesperson

Investors see hundreds of pitches, so yours needs to stand out. Approach it like an excellent sales presentation—engaging, informative, and tailored to your audience.

Crafting a Compelling Narrative

Your pitch should tell a story. Investors need to understand your problem, why it matters, and how your solution is unique. A compelling narrative engages an investor’s brain’s emotional and logical sides.

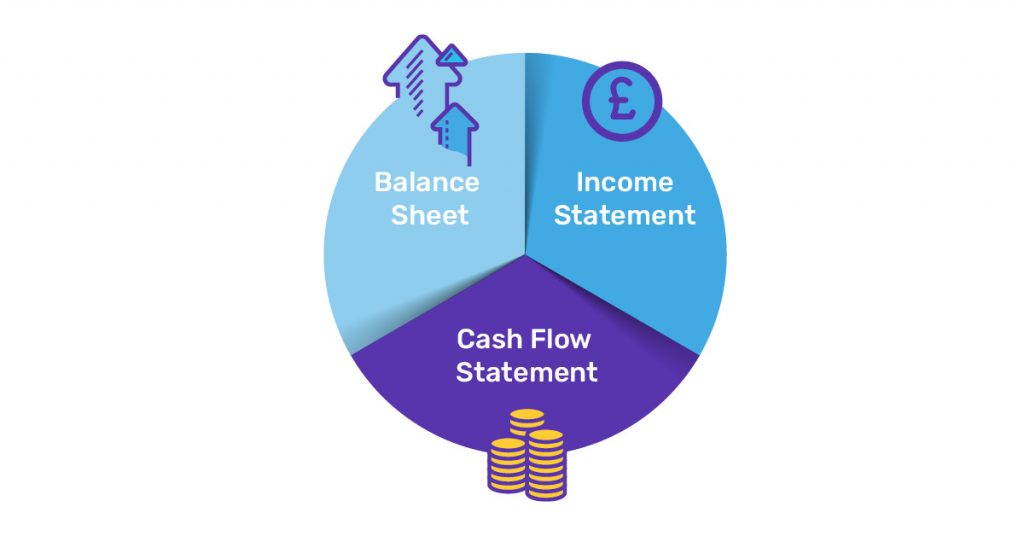

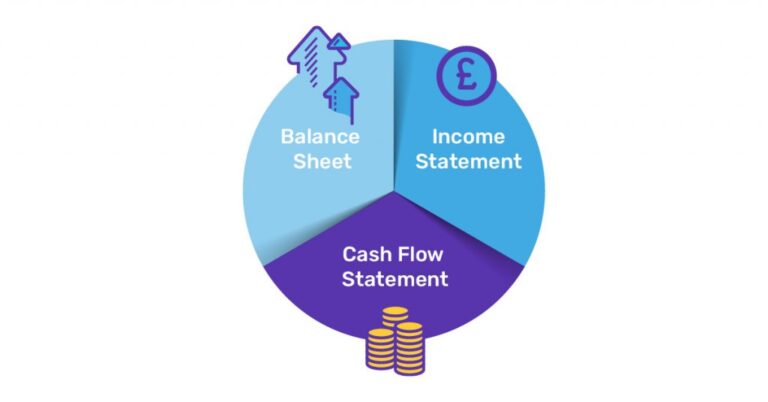

Making Numbers Work in Your Favour

While the story is crucial, numbers are what will ultimately sell investors on your startup. You need to back your narrative with hard data.

Knowing Key Metrics and Values

Understand the key metrics investors care about—like customer acquisition cost (CAC), lifetime value (LTV), and churn rate. These figures give investors a clear picture of the health and potential of your business.

Developing Trust and Credibility

Investors need to trust you before they invest their money. You can build this trust through transparency, accountability, and delivering on small promises before asking for big commitments.

Proof of Concept and Traction

Demonstrating traction is critical. Whether it’s user growth, revenue, or partnerships, you need to show that your idea works in the real world. Investors are more likely to back something that has a proven track record.

Social Proof and Testimonials

Another way to establish credibility is by showcasing testimonials from satisfied customers, endorsements from industry experts, or previous investor backing. Social proof can go a long way in building trust.

Engaging in Effective Pitching

Your pitch is your chance to make a lasting impression. You need to approach it with the same rigor and confidence that a seasoned salesperson would.

Pitching with Confidence and Clarity

Clarity is key when pitching. You want to ensure investors fully grasp your vision and your ask. Present your business in a straightforward manner, making it easy for them to see the value.

Overcoming Investor Objections

Like in any sales situation, objections will arise. Whether it’s concerns over your market size, competition, or business model, you need to be prepared to handle these challenges. Address objections calmly and provide clear, well-reasoned answers.

Closing the Deal: Turning Interest into Investment

Getting an investor interested is only half the battle. The real challenge is closing the deal. Just like in sales, your goal is to move from a warm lead to a signed agreement.

Negotiation Strategies and Terms

Negotiating terms can be tricky, but it’s a crucial part of securing investment. Be ready to discuss valuation, equity, and investor roles. Approach these conversations strategically, balancing your needs with the investor’s expectations.

Long-term Sales: How to Maintain Investor Relationships

After securing investment, the sales process doesn’t end. Keeping investors engaged and satisfied requires ongoing communication and transparency. By treating investors like long-term partners, you can build a foundation for future funding rounds.

Conclusion

Raising investment is a lot like closing a sale—it’s about persuasion, trust, and delivering value. To succeed, you need to be able to sell your vision convincingly, back it up with data, and foster relationships that turn potential into actual capital. Mastering sales skills is not just helpful but essential if you’re serious about raising investment for your startup.