India’s startup ecosystem has dramatically evolved in recent years, with a wave of innovative enterprises seeking to leave their mark. Many of these startups, having reached significant growth milestones, now consider the next monumental step in their journey—going public through an Initial Public Offering (IPO). This transition offers startups access to large-scale capital, increased credibility, and liquidity for early investors, positioning them as key players in the public market.

Why Pursue an IPO?

The IPO process is not just about raising funds; it symbolises maturity and commitment. Founders who aim for an IPO from the outset are often driven by a vision to create a lasting legacy, building an organisation that outlives its founders. An IPO forces a company to become more structured, professionalised, and transparent, making it attractive to institutional investors and partners.

Going public can unlock new pathways for growth and provide liquidity to early investors. Founders are incentivised to scale their businesses to reach profitability while ensuring long-term value creation. For instance, companies like Zomato and Nykaa, despite being unprofitable at the time of listing, succeeded by proving their potential for growth and dominance in their respective sectors.

Is an IPO Right for Your Startup?

While an IPO can be the ultimate aspiration for many startups, it is unsuitable for all. Traditionally, companies with steady cash flows and long operational histories were considered prime candidates for going public. However, the tech revolution has shifted this paradigm. Today’s startups, especially those in the technology space, often aim for an IPO based on metrics beyond profitability, such as customer growth, gross merchandise value (GMV), or other relevant non-financial indicators.

A sustainable business model is crucial. Startups must demonstrate strong growth prospects and an eventual path to profitability. SEBI (Securities and Exchange Board of India) permits loss-making startups to list, but only if they can substantiate their growth trajectory. Additionally, companies should possess a clear business plan and vision for using proceeds from the IPO, as SEBI closely scrutinises these aspects in the listing process.

Key Milestones Before Listing

- Three-Year Financial Track Record: Startups should aim for a three-year track record of financial performance, ideally under the same company name. This builds investor confidence and reduces scrutiny during the listing process.

- Non-Financial Growth Metrics: Startups should focus on metrics such as GMV, EBITDA, and customer base, which can be more critical than traditional revenue metrics in specific sectors.

- Valuation Benchmarks: Companies in niche markets may need help benchmarking their valuations against domestic peers. Global comparisons based on metrics like user growth or market share can provide necessary guidance in such cases.

- Capital Requirements: Startups requiring large capital injections for growth, acquisitions, or debt repayment can benefit from IPOs by accessing a broader investor base.

When is the Right Time to List?

Timing an IPO requires careful consideration. A startup should contemplate going public once it has achieved stable performance, meaningful scale, and predictable growth metrics. The company should ideally aim for or at least EBITDA profitability before listing. Additionally, having a significant market share in a large and growing market is crucial to convince investors of the long-term viability of the business.

Moreover, regulatory mandates require that the public own 25% of the overall shareholding within three years of the IPO, ensuring sufficient liquidity. For instance, a company aiming for a $100 million IPO would require a post-issue valuation of $400 million to meet this criterion.

Regulatory and Compliance Considerations

The role of SEBI in the IPO process is pivotal. SEBI’s primary mandate is safeguarding investor interests while promoting a fair and transparent securities market. As such, startups must adhere to stringent disclosure norms, providing detailed financial and non-financial information, risk factors, and corporate governance practices. SEBI’s meticulous review process may require additional disclosures or clarifications before approval, so companies must be prepared for possible delays.

Additionally, SEBI has worked to streamline the listing process for tech-driven startups, allowing them to access public markets sooner than traditionally required. This has led to a growing number of Indian startups opting for domestic listings over foreign markets, particularly given the rising interest from retail investors in India.

Domestic vs. International Listings

Indian startups are increasingly choosing to list domestically despite the option of listing abroad. Several factors contribute to this trend, including India’s maturing retail investor base, regulatory improvements, and a growing economy. Companies that derive most of their value from the Indian market, such as e-commerce or fintech firms, find greater brand recognition and valuation premiums in India.

In contrast, listing in foreign markets like the U.S. often requires a more extensive revenue base and adherence to stricter disclosure and regulatory requirements. Indian SaaS companies, for example, can go public in India with just $125 million in revenue, compared to the $300 million often expected in the U.S.

Promoter Obligations and Rights Post-IPO

One key decision during the IPO process is whether to be classified as a Promoter-Driven Company (PDC) or a Professionally Managed Company (PMC). In a PDC, the promoters are liable for the accuracy of offer document disclosures and post-listing obligations, such as maintaining public shareholding requirements. Additionally, 20% of the promoter’s post-IPO holdings are locked in for 1.5 to 3 years, ensuring long-term commitment.

To meet regulatory requirements for a PMC, founders may need to reduce their shareholding and give up certain control rights, such as board representation. Both routes involve substantial compliance costs and obligations, but the choice depends on the company’s structure and long-term goals.

Preparing for the IPO Process

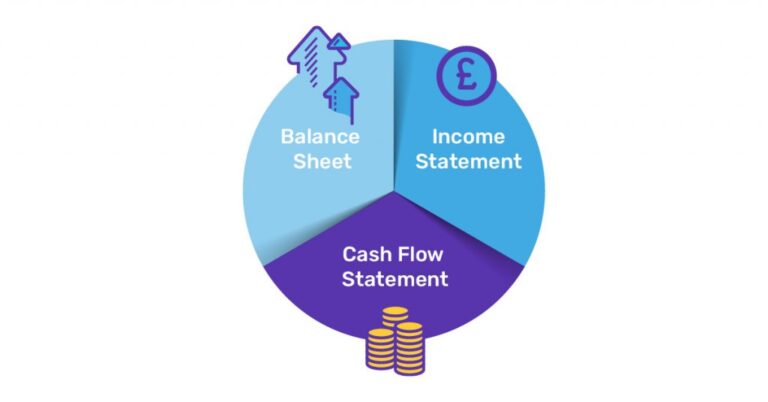

Preparing for an IPO involves several steps, including governance improvements, management maturity, and transparent financial reporting. Startups should be prepared for the rigorous demands of public scrutiny, including adherence to quarterly financial reporting and stringent disclosure norms.

The costs of going public are also significant, ranging from 3% to 7% of the IPO proceeds, depending on the complexity of the offering. These include underwriting fees, due diligence, legal, and compliance costs.

Conclusion

The decision to go public is a defining moment in a startup’s lifecycle, offering access to capital and enhancing credibility. However, it requires thorough preparation, from financial reporting and governance improvements to regulatory compliance. Indian startups, particularly those in tech-driven sectors, are increasingly choosing domestic IPOs due to favourable market conditions, retail investor participation, and valuation premiums. By carefully considering timing, capital needs, and regulatory requirements, startups can successfully navigate the IPO journey and set the stage for long-term success.