Securing investment for your startup is a critical step in turning your vision into reality. Even the most promising ideas can only get off the ground with sufficient capital. The startup landscape is highly competitive, with countless entrepreneurs vying for investors’ attention, making it essential to stand out. Investors are not just looking for good ideas; they seek scalable businesses backed by a solid team for sustainable growth.

Raising investment is multifaceted and often intimidating, particularly for first-time founders. You’ll need to navigate a landscape that includes choosing suitable funding sources, preparing compelling pitches, and understanding investor expectations. Adapting to different financing stages—seed funding, venture capital, or strategic partnerships—requires foresight and preparation. As markets evolve and investors become more discerning, entrepreneurs must employ innovative strategies to increase their chances of success.

This guide offers practical techniques to help you secure the investment you need. By drawing on the experiences of businesses that have successfully raised substantial capital, you’ll gain valuable insights into what works and how to apply these methods to your startup. From refining your pitch to leveraging strategic partnerships, these strategies will help you navigate the complex world of fundraising.

1. Develop and Commit to a Compelling Vision

Your vision is the driving force behind your startup, and investors must understand and believe in it. A clear, compelling vision demonstrates purpose and direction. It’s not enough to have a good idea—you need to show how your product or service will significantly impact your industry.

Investors want to know you are passionate about your mission and fully committed to seeing it through. This vision needs to be more than a fleeting idea; it should be a well-developed concept that aligns with long-term goals and a clear growth trajectory. Remember, while your vision may evolve, the core mission must remain consistent, allowing you to stay on brand and build trust.

2. Build a Strategic Brand Identity

A strong, cohesive brand is critical for investor trust and market positioning. Your startup’s brand should convey what you do and why it matters. Before approaching investors, take the time to define your brand’s mission, values, and audience. Ensure that these elements are reflected in all aspects of your business, from product design to customer interactions.

As your company evolves, you may encounter unexpected challenges or shifts in direction. However, staying true to your core values and overarching brand message will allow you to maintain consistency, even when your product or service changes over time. This builds credibility with investors, who are more likely to invest in a company that stays true to its foundational principles.

3. Create More Than Just an Idea—Prove Viability

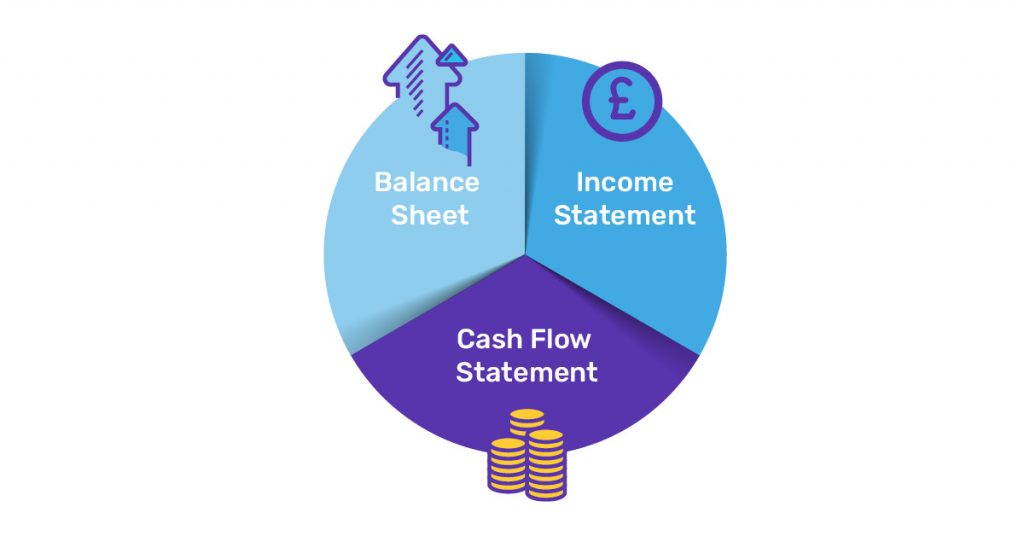

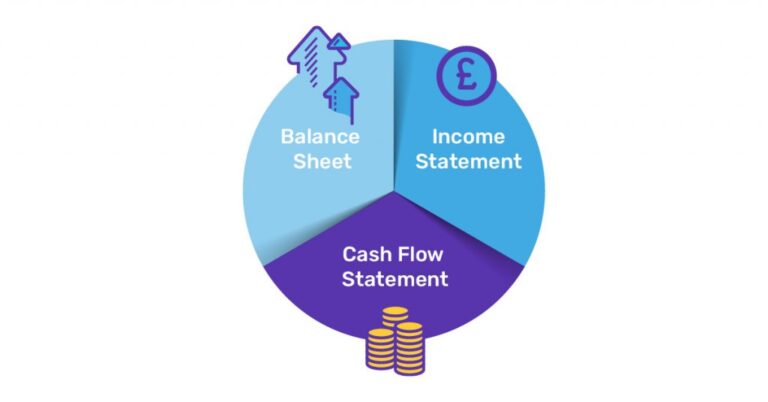

A brilliant idea alone won’t secure funding. Investors want to see more than an initial concept; they need proof that your idea can thrive in the real world. Focus on developing a detailed business model outlining your growth strategy, market penetration, and revenue generation. Demonstrate how you plan to scale and sustain profitability over time.

Your pitch should articulate the problem you’re solving and how you plan to execute the solution effectively. Show investors you’ve thought through potential obstacles and a clear roadmap for overcoming them. Use data, case studies, and prototypes to back up your claims and prove the viability of your business.

4. Leverage a ‘Friends and Family’ Round to Gain Momentum

The first investment round is often the hardest, which is why many startups start by raising funds from friends and family. This initial capital allows you to prove your concept and establish credibility. Securing small investments from your personal network creates momentum to make future fundraising efforts easier.

Be transparent with your friends and family about the risks involved, and treat this round as professionally as you would any other. Document everything, including the terms of the investment, and use the funds wisely to build a prototype, secure early customers, or conduct market research. The success of this round sets the stage for raising additional capital.

5. Offer Your IP to Create Strategic Partnerships

Sometimes, offering your intellectual property (IP) for free can be brilliant. You can prove its value and build credibility by allowing strategic partners or early adopters to test your product without cost. These partnerships can lead to valuable endorsements, early traction, and potential investor interest.

Be strategic about who you offer your IP to. Choose partners that align with your long-term goals and can help you build credibility in your target market. Offering your IP can demonstrate confidence in your product and its market potential, which is attractive to investors.

6. Set Clear, Measurable Targets

Investors want to see that your business has a clear direction. Setting measurable targets shows that you have a plan and can execute it. Break your goals into quarterly milestones, and track your progress closely. These benchmarks allow you to demonstrate traction and build investor confidence.

When presenting to investors, be prepared to discuss not only your past achievements but also your future targets. Provide detailed timelines, anticipated challenges, and the steps you will take to overcome them. This level of preparedness instils trust and demonstrates your commitment to achieving success.

7. Surround Yourself with the Right Partners

Having the right partners can make or break your fundraising efforts. Surround yourself with advisors and team members who bring expertise, credibility, and connections. Investors often invest in teams just as much as in ideas, so building a well-rounded and experienced team is crucial.

Seek mentors and partners with a track record of success in your industry. Their expertise can help you navigate the fundraising process, refine your business model, and connect with potential investors. Additionally, working with a reputable investment-raising consultancy can provide the guidance and resources needed to secure capital more effectively.

8. Build a World-Class Team

Investors know that a startup is only as strong as the team behind it. When assembling your team, focus on bringing in individuals with a proven track record of success who can help you scale quickly. Look for experts in key areas such as product development, marketing, finance, and operations.

A strong team signals to investors that you have the capacity to execute your business plan effectively. Highlight your team’s collective experience and accomplishments during investor meetings to build confidence in your startup’s ability to succeed.

9. Actively Network and Build Relationships

Networking is an essential part of raising investment. Start by building relationships with potential investors, industry leaders, and other entrepreneurs. Attend events, participate in panels, and seek opportunities to showcase your business.

The relationships you build early on can pay off when you start fundraising. Warm up potential investors by informing them about your progress and inviting them to be part of your journey. Over time, these relationships can turn into valuable investment opportunities.

10. Ask for Advice, Not Money

When approaching potential investors, ask for advice rather than pitch for funding. This approach allows you to build relationships and gain valuable insights to improve your business. Over time, as the relationship develops, investors may become more inclined to invest.

Asking for advice creates a collaborative dynamic, which is often more appealing than a straightforward pitch. It also demonstrates humility and a willingness to learn, traits investors appreciate in entrepreneurs. Focus on building rapport and gaining insights before transitioning to a conversation about funding.

Conclusion

Raising investment is complex and often challenging, but it becomes significantly more manageable with the right strategies. Success in securing investment starts with a clear and compelling vision that drives your business forward and resonates with investors. You can set your business apart from competitors by building a strong brand that reflects your mission, values, and market potential.

Assembling the right team is equally critical. Investors are not just investing in ideas but in the people behind them. A talented, cohesive team that complements your vision and can execute the business plan increases investor confidence. Setting clear, measurable goals is another essential step, providing a roadmap that shows how the investment will lead to growth and returns.

Equally important is the ability to build relationships with investors. Vital networking can provide access to capital and invaluable mentorship. Proving your concept through data, market validation, and customer traction demonstrates that your business has the potential for long-term success. Finally, don’t hesitate to seek advice from seasoned entrepreneurs or investors—learning from their experience can help you avoid common pitfalls and navigate challenges. By focusing on these core elements, you’ll be well on your way to securing the funding you need to scale your business and achieve lasting success.