Raising capital is one of the most critical stages in building and scaling a successful business. Whether you are a startup entrepreneur seeking seed funding or an established company looking to expand, securing the right financing is crucial for sustained growth. This article explores comprehensive strategies to raise capital, offering actionable insights to guide your decision-making process. These strategies cover traditional and modern methods, ensuring your business finds the right fit for its financial needs.

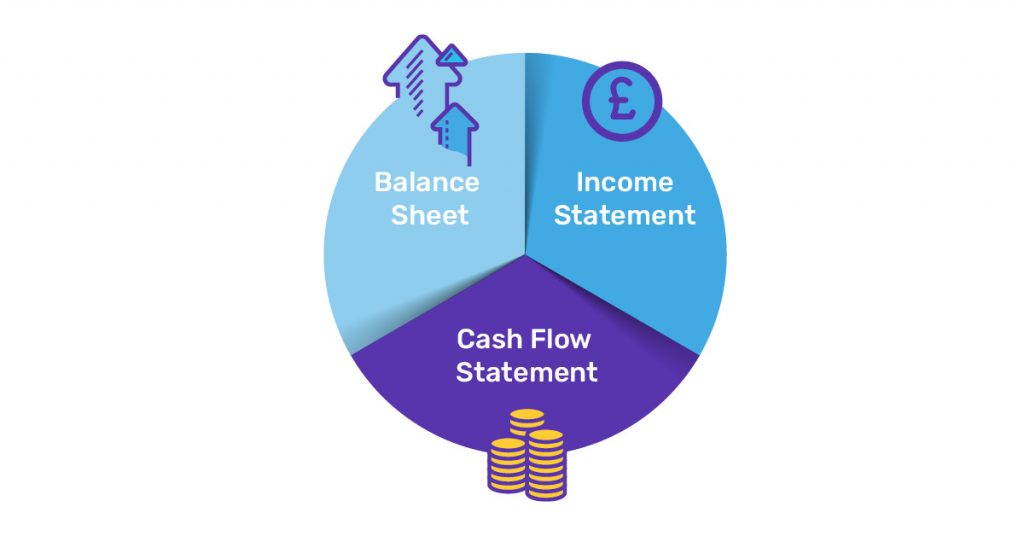

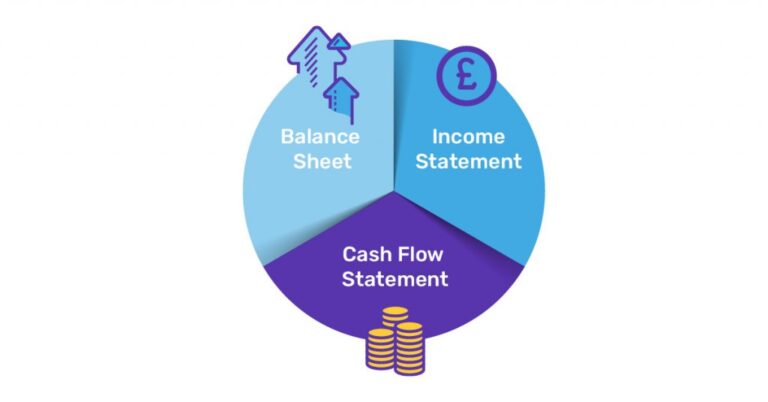

Debt vs. Equity Financing: Which Path to Choose?

Businesses generally raise capital through two primary methods: debt financing and equity financing. Each has distinct advantages and challenges. Understanding these can help align your financial strategy with your long-term business objectives.

Equity Financing

Equity financing involves offering shares of your business in exchange for capital. Investors take on partial ownership, which means you share profits and losses. This method is desirable for startups that require significant investment to scale quickly but may need more immediate revenue streams to service debt.

- Advantages: No obligation to repay investors if the business doesn’t perform as expected. Additionally, investors often bring expertise and networking opportunities.

- Disadvantages: Dilution of ownership and potential loss of complete control over the business.

Debt Financing

Debt financing allows you to borrow funds that must be repaid with interest. Unlike equity financing, debt does not dilute your ownership. However, the obligation to make regular repayments means this option suits businesses with stable revenue streams.

- Advantages: Full control over the business remains with the owners.

- Disadvantages: Regular repayments can strain cash flow, especially for young businesses.

When to Use Both

Many businesses employ a mix of debt and equity financing to maintain a balanced capital structure. This hybrid approach can minimise risks and maximise growth potential.

Bootstrapping: Fund It Yourself

Bootstrapping refers to funding your business without external help, relying entirely on personal savings or reinvesting profits. While this method gives you complete control and avoids the need to repay loans or dilute ownership, it requires significant financial discipline and may limit your business’s growth potential.

Why Bootstrapping Works

Bootstrapping fosters a culture of prudence and calculated risk. Every expense is scrutinised, and there is often a greater focus on profitability over rapid expansion. Spanx, founded by Sara Blakely, is a classic example of a company that started with just $5,000 and grew into a billion-dollar empire without external funding.

Key Considerations: To successfully bootstrap, you must focus on efficient cash flow management and low-cost growth strategies. Bootstrapping may limit scalability if your business requires significant upfront capital for research, equipment, or technology.

Business Loans: A Tried-and-True Option

Business loans offer a traditional route to securing capital, typically through banks or credit unions. These loans are best suited for businesses with established revenue streams, as lenders require assurance that they can recoup their investment.

Applying for a Business Loan

To obtain a business loan, you’ll need a detailed business plan that includes financial projections and a clear repayment strategy. The interest rate and repayment terms will depend on your creditworthiness and the business’s economic health.

Case Study: Coffee Republic, a UK-based coffee chain, financed its initial expansion through business loans. This enabled the company to establish its first few locations and gain a foothold in the competitive café industry.

Microloans: Small Capital with Big Impact

Microloans are smaller loans offered by non-traditional financial institutions or non-profit organisations, typically ranging from £500 to £50,000. Microloans are especially beneficial for startups needing only a modest capital infusion to start or scale up.

How Microloans Work

Entrepreneurs who may need more credit history or collateral to qualify for larger loans due to a lack of credit history or collateral often turn to microloans. While these loans can be a lifeline for small businesses, they may come with higher interest rates than traditional loans due to the perceived risk.

Example: An online boutique might use a microloan to fund initial inventory purchases or cover the costs of setting up a website.

Crowdfunding: Power of the Masses

Crowdfunding allows entrepreneurs to raise capital by pitching their ideas to a large group of people, typically via online platforms like Kickstarter, Seedrs, or Crowdcube. Backers contribute small amounts to reach a funding goal collectively.

Benefits of Crowdfunding

In addition to raising capital, crowdfunding provides an opportunity to validate your business idea and engage with potential customers. Crowdfunding can be structured as either reward-based or equity-based. With reward-based crowdfunding, backers receive a product or service in return for their investment, whereas equity crowdfunding gives backers a stake in the company.

Notable Success Story: BrewDog, a craft beer company, raised over £40 million via multiple crowdfunding rounds on Crowdcube, leveraging a loyal community of backers and innovative product offerings.

Angel Investment: Capital and Expertise

Angel investors are wealthy individuals who provide capital in exchange for equity in the business. Often, they are entrepreneurs themselves and bring valuable business expertise and networks along with their investment. Angel investments are typically more flexible than venture capital, with angels willing to invest at earlier stages of a startup’s growth.

How to Attract Angel Investors

Your business needs to demonstrate high growth potential to secure angel investment. A strong business plan, a compelling vision, and a track record of progress will make your company more attractive to these investors.

Pro Tip: Establish relationships within your industry. Angel investors often invest in businesses where they can add value beyond just providing capital.

Venture Capital: Scaling for High Growth

Venture capitalists (VCs) are institutional investors who provide significant capital to startups in exchange for equity. Venture capital is typically aimed at high-growth businesses in technology, biotech, and fintech sectors.

Why Venture Capital Matters

VCs offer more than money; they often offer mentorship, strategic direction, and access to a vast network of industry connections. Venture capital is an attractive option for startups that need substantial funding to scale quickly but are willing to trade ownership and control for the opportunity to grow exponentially.

VC Example: Dropbox, now a global tech giant, raised significant VC funding to scale its operations and grow its user base, becoming a leader in the cloud storage market.

Private Equity: Strategic Capital for Mature Businesses

Private equity (PE) firms invest in established businesses that need significant capital for growth or restructuring. Unlike VCs, PE firms often take a controlling stake in the companies they invest in.

When to Consider Private Equity

Private equity suits businesses with solid growth potential but needs expertise and significant capital to expand or transform. PE investors typically focus on long-term profitability and may make substantial operational changes to achieve this.

Case Study: Burger King underwent a significant transformation after receiving a large private equity investment, which helped reposition the brand and expand globally.

Government Loans and Grants: Support from the Public Sector

Many governments offer loan programs or grants to support small businesses and startups. These can be a vital source of non-dilutive capital, meaning you don’t relinquish ownership or control in exchange for funding.

How to Qualify for Government Funding

Eligibility criteria for government loans and grants vary. Still, they typically require a well-thought-out business plan and may focus on specific sectors such as technology, sustainability, or job creation.

Conclusion

Raising capital is a multifaceted process that requires a deep understanding of the available financing options and how they align with your business’s goals and operational needs. Whether through debt, equity, or alternative funding methods, selecting the right strategy can catalyse your startup’s success.