Selling a business idea is crucial to transforming a concept into a thriving enterprise. Successfully convincing investors to believe in your vision requires more than just a good idea; it demands a meticulously crafted pitch that resonates with potential backers. This guide outlines the essential steps for presenting your business idea in a way that maximises its appeal, ensures clarity, and builds investor confidence.

Understanding Your Target Audience

Researching Investor Profiles

Knowing who your investors are is essential to tailoring your pitch effectively. Begin by researching their investment history, preferences, and the types of startups they usually fund. Understanding their priorities allows you to highlight the aspects of your business that align with their interests. For example, if an investor is focused on sustainable technology, emphasising your green solutions can make your pitch more compelling.

Tailoring Your Message

Once you’ve gathered insights about potential investors, customise your pitch to address their specific criteria. This involves focussing on the aspects of your business that match their investment goals, ensuring that your presentation resonates deeply with them.

Crafting a Powerful Elevator Pitch

The Art of Conciseness

An elevator pitch is your opportunity to make a solid first impression in a brief timeframe—typically 30 to 60 seconds. This pitch should convey what your business does, the problem it addresses, and the unique value it offers. The goal is to pique the investor’s interest and encourage them to want to learn more.

Refinement and Practice

Creating a compelling elevator pitch requires practice. Deliver it multiple times to peers and mentors, refining it each iteration. The more polished and confident your delivery, your pitch will be more persuasive.

Developing a Comprehensive Business Plan

A well-structured business plan is crucial for demonstrating to potential investors that you have a clear and strategic path to success. This document serves as a roadmap for your business and showcases your preparedness and understanding of the market. The following sections are essential components that your business plan should include:

Executive Summary: A Snapshot of Your Business Concept

The Executive Summary is the first impression of your business plan and should provide a concise yet compelling overview of your business idea. It is essential to succinctly capture the essence of your business, including your mission, vision, and key objectives. This section should also highlight the unique value proposition of your product or service, giving investors a reason to be interested in what you are offering. Think of the Executive Summary as your elevator pitch in written form—it should be engaging enough to make investors want to learn more about your venture.

Market Analysis: In-Depth Research on Your Target Market and Competitors

A detailed Market Analysis is fundamental to your business plan as it demonstrates your understanding of the industry landscape. This section should include thorough research on your target market, identifying your potential customers’ demographics, preferences, and purchasing behaviour. Additionally, a comprehensive analysis of your competitors is essential. This involves identifying who they are, understanding their strengths and weaknesses, and how your business can gain a competitive edge. By providing a clear picture of the market dynamics, you can show investors that there is a viable opportunity for your business to succeed.

Business Model: How Your Business Will Generate Revenue

The Business Model section is where you explain the mechanics of how your business will make money. It should explain your revenue streams, pricing strategy, cost structure, and profit margins. Whether selling products, offering services, or combining both, it’s important to articulate how your business will sustain itself financially in the long run. Investors are keen to understand how you plan to generate revenue and how scalable and sustainable your business model is.

Marketing Strategy: Attracting and Retaining Customers

Your Marketing Strategy is crucial for showing how you plan to reach and retain customers. This section should outline your branding, advertising, sales channels, and customer engagement plans. It’s essential to describe your tactics to attract your target audience, convert leads into customers, and foster customer loyalty. Investors will be particularly interested in how you plan to differentiate your brand and create a strong presence in the market. A well-thought-out marketing strategy can demonstrate that you have a clear plan for achieving growth.

Financial Projections: Forecasting Financial Performance

Financial Projections are a critical component of your business plan, as they provide a roadmap of your expected financial performance over the next five years. This section should include detailed forecasts of your income, expenses, cash flow, and profitability. Investors look for realistic and data-backed financial projections that show you have a solid grasp of your financial needs and potential. It’s essential to provide different scenarios—optimistic, pessimistic, and most likely—so investors can see how your business might perform under various conditions. Accurate and detailed financial projections can help build investor confidence and show you are prepared for the economic challenges ahead.

The Importance of Detail in Your Business Plan

When crafting your business plan, providing detailed and well-researched information is essential. Investors want to see that you have carefully considered every aspect of your business. This includes in-depth financial forecasting, thorough market analysis, and a clear understanding of your business environment. A well-detailed business plan demonstrates your commitment to your business and builds confidence among investors. They need to be assured that you have anticipated potential challenges and have a plan to overcome them. The more detailed and comprehensive your business plan, the more likely you will secure the investment you need.

Building a Strong Value Proposition

Defining Your Unique Value

Your value proposition is a statement that communicates the unique benefits your product or service offers to customers. It’s essential to identify the specific needs of your target market and articulate how your offering meets those needs better than any other option available. This involves understanding your customers’ pain points and demonstrating how your product or service provides a superior solution. A strong value proposition differentiates your business from competitors and is critical to attracting and retaining customers.

Communicating Your Value Effectively

Effectively communicating your value proposition goes beyond simply stating the features of your product or service. It’s about telling a story that resonates with your customers and explains why your offering is the best solution to their problem. This requires understanding your target audience’s emotional and practical needs and crafting a message that speaks directly to them. Whether through your website, marketing materials, or sales pitches, your value proposition should be clear, compelling, and consistent. By effectively communicating your value, you can build a strong connection with your customers and create a loyal customer base.

Creating an Engaging Pitch Deck

Essential Slides for a Compelling Pitch

A pitch deck is a visual presentation that gives potential investors an overview of your business. It’s a crucial tool for conveying the potential of your business concisely and engagingly. The following slides are essential for creating a compelling pitch deck:

- Problem and Solution: Start by clearly defining the problem your business addresses and how your product or service provides a unique solution. This will help investors understand your business’s relevance and impact.

- Market Opportunity: Outline the size and growth potential of your target market. This slide should provide data supporting your business idea’s viability and scalability.

- Business Model: Explain how your business plans to generate revenue. This slide should detail your revenue streams, pricing strategy, and how you plan to achieve profitability.

- Traction: Showcase your business’s progress so far, such as sales figures, customer growth, or key partnerships. Traction is a strong indicator of your business’s potential for success.

- Team: Highlight your team members’ experience, skills, and expertise. Investors often invest as much in the team as they do in the business idea.

- Financial Projections: Provide realistic and data-backed financial forecasts for the next five years. This slide should demonstrate that you have a clear plan for achieving financial success.

- The Ask: Conclude with a clear statement of how much funding you seek and how you plan to use it. Be specific about the milestones you intend to achieve with the investment.

Visual Appeal

The design of your pitch deck is just as important as the content. Use clean, professional visuals to make your slides more engaging. Ensure that each slide supports your overall narrative and reinforces key points.

Demonstrating Market Validation

Proof of Demand

Market validation is critical in proving a demand for your product or service. This can be demonstrated through customer surveys, pre-orders, or initial sales. The more evidence you can present that customers are interested in your offering, the more likely investors will be to support your business.

Presenting Data

When presenting market validation, use precise, concise data that shows customer feedback, market size, and sales trends. This data should be easily understood and directly relevant to your business model.

Networking and Building Relationships

Importance of Networking

Building relationships with potential investors is as important as the pitch itself. Networking allows you to establish trust and credibility over time. Attend industry events, join relevant groups, and engage with investors on platforms like LinkedIn.

Consistent Engagement

Regular communication with potential investors keeps your business on their radar. Provide updates on your progress, share industry insights, and continue building rapport. This ongoing engagement can lead to more vital investor interest and better funding opportunities.

Highlighting Your Team’s Strengths

Team Presentation

Investors often invest as much in the team as they do in the idea. Showcase your team’s expertise by highlighting each member’s relevant experience, skills, and accomplishments. Include professional bios and emphasise each member’s unique contributions to the business’s success.

Demonstrating Capability

Your team slides should demonstrate that your team can execute the business plan successfully. This builds investor confidence in your ability to turn the business idea into a thriving enterprise.

Addressing Risks and Challenges

Risk Mitigation

Acknowledging potential risks shows investors that you are realistic and prepared. Clearly outline the risks your business may face and present strategies for mitigating these risks. This demonstrates foresight and a proactive approach to potential challenges.

Transparent Communication

Be open about the challenges you anticipate and how you plan to overcome them. This transparency can help build trust with investors and shows you have a well-thought-out plan for navigating difficulties.

Showcasing Traction and Milestones

Demonstrating Progress

Traction is one of the most convincing pieces of evidence you can present to investors. It shows that your business is already gaining momentum and achieving key milestones. This could include sales figures, user growth, or strategic partnerships.

Presenting Metrics

Use specific, quantifiable metrics to illustrate your progress. This could include customer acquisition costs, lifetime value, or retention rates. Presenting these metrics effectively reinforces your business’s viability and potential for growth.

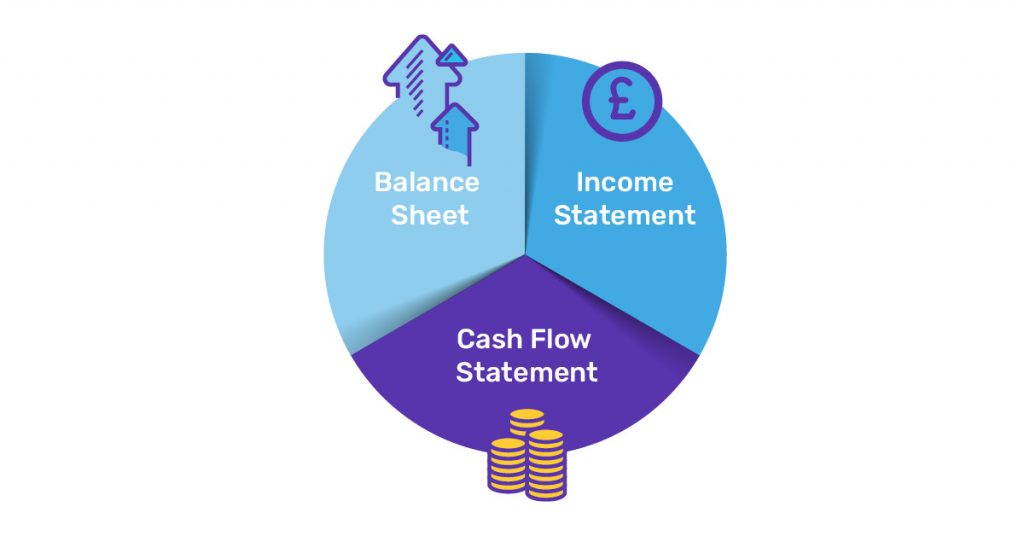

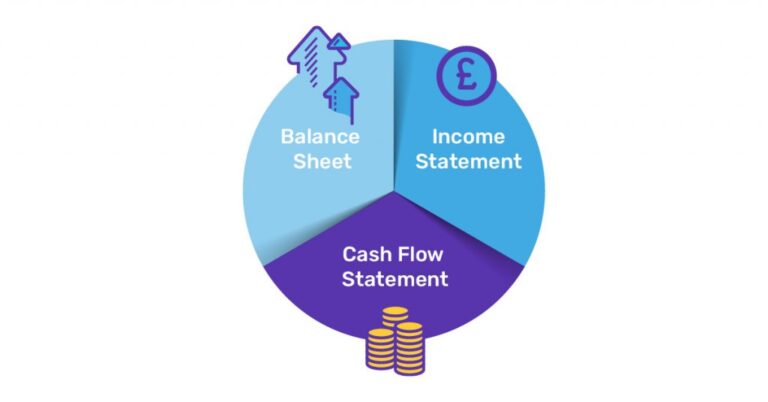

Conveying Financial Projections

Importance of Realism

Financial projections are a critical component of any pitch. They provide investors with a glimpse into your business’s future performance. Ensure your projections are realistic, data-backed, and based on thorough market analysis.

Clear Presentation

Present your financial forecasts clearly and understandably. Include vital financial statements like income, cash flow, and balance sheets. These should be easy for investors to digest and instil confidence in your financial management.

Crafting a Strong Closing Argument

Summarising Key Points

Your closing argument is your final opportunity to leave a lasting impression. Summarise the key points of your pitch, highlighting the unique aspects of your business that make it a worthwhile investment.

Call to Action

End your pitch with a clear and compelling call to action. Encourage investors to take the next step, whether scheduling a follow-up meeting, requesting additional information, or committing to an investment.

Preparing for Investor Questions

Anticipating Queries

It is crucial to be prepared for investor questions. Investors will want to investigate your business plan, financials, and market strategy more deeply. Anticipate common questions and prepare comprehensive answers.

Practicing Responses

Practice answering questions calmly and confidently. Conduct mock Q&A sessions with mentors or peers to improve your ability to respond effectively under pressure.

Leveraging Social Proof and Testimonials

Building Credibility

Social proof can be a powerful tool in convincing investors. Gather and present testimonials, case studies, and endorsements demonstrating business confidence. This can help build credibility and trust with potential investors.

Strategic Presentation

Present social proof that directly supports your business’s value proposition. Highlight endorsements from industry experts or satisfied customers that reinforce your business’s strengths.

Continuous Practice and Improvement

Importance of Rehearsal

The more you practice your pitch, the more polished and effective it will become. Rehearse your presentation regularly, incorporating feedback from others to improve your delivery continuously.

Real-World Experience

Participate in pitch events and competitions to gain real-world experience. These opportunities can provide valuable feedback and help you refine your pitch further.

Effective Follow-Up Strategies

Maintaining Engagement

Following up with investors after meetings is crucial to maintaining their interest. Develop a follow-up plan that includes timely emails, calls, and updates on your business’s progress.

Personalised Communication

Ensure your follow-ups are personalised and provide additional information that may interest the investor. Keeping investors engaged can significantly increase the likelihood of securing funding.

Conclusion

Effectively selling your business idea requires thorough preparation, clear communication, and a strategic presentation. By following the steps outlined in this guide, you can craft a compelling pitch that resonates with investors, addresses their concerns, and showcases your business’s unique potential. With dedication and persistence, you can turn your business idea into a successful venture and secure the investment needed to fuel your growth.