When developing a business plan to attract potential investors, embracing the principle that less is often more is essential. A concise yet well-structured plan can often be more compelling than one that is overly detailed. Investors typically have limited time and attention spans, so a streamlined plan communicating critical information clearly and efficiently is more likely to capture their interest.

You can create a plan that stands out by delivering a coherent narrative highlighting your business’s core aspects— market opportunity, unique value proposition, and financial projections. This approach makes it easier for investors to understand your vision and demonstrates your ability to distil complex information into actionable insights, increasing the likelihood of securing investment.

The Art of Simplification

Why Less is More

In securing investment, a business plan is crucial to effectively presenting your venture’s potential and strategy. However, the temptation to include every detail can lead to information overload, diluting the core message and deterring potential investors. Instead of bombarding them with an exhaustive amount of data, aim to craft a business plan that is both clear and engaging.

This involves distilling your business’s vision, objectives, and strategies into a coherent and compelling narrative. A concise and well-organised plan showcases your ability to communicate your ideas effectively and respects the investor’s time by succinctly presenting essential information.

Key Takeaway: A well-crafted business plan focusses on presenting critical information clearly and succinctly. This approach helps investors quickly understand your vision and value proposition without getting bogged down by excessive details.

Balancing Detail and Clarity

One of the most common mistakes founders make is assuming that more detail equals a more robust business plan. While details are essential, seasoned entrepreneurs recognise that clarity often arises from brevity. An overly detailed plan can obscure the main points, making it challenging for investors to grasp the overall vision. By prioritising the most impactful information and avoiding extra details, you ensure that your business plan effectively communicates the essential aspects of your business without overwhelming the reader.

Key Takeaway: Focus on delivering the most impactful information in your business plan. Avoid overloading it with unnecessary details to maintain clarity and ensure investors can easily see the big picture.

Essential Components of an Investor-Ready Business Plan

Executive Summary

- Purpose: The executive summary is a compelling introduction to your business plan. It should encapsulate the essence of your business, highlighting the key components such as your business concept, market potential, and financial forecasts.

- Key Elements:

- Overview of the business concept

- Summary of market potential

- High-level financial projections

- Objective: This section is your first impression; therefore, it needs to be engaging and persuasive to capture the interest of potential investors.

Market Analysis

- Purpose: This section helps investors understand the market landscape and the business opportunity. It provides insights into market dynamics and how your business fits within this environment.

- Key Elements:

- Market size and growth potential

- Emerging trends and industry developments

- Target audience and customer demographics

- Objective: Demonstrate how your business plans to capitalise on market opportunities and your strategy for reaching and serving your target market.

Business Model

- Purpose: To outline how your business will generate revenue and sustain itself financially.

- Key Elements:

- Revenue streams and pricing strategy

- Sales forecast and financial sustainability

- Objective: Clarify how your business will earn revenue and ensure long-term growth.

Competitive Analysis

- Purpose: To identify competitors and explain how your business differentiates itself from others in the market.

- Key Elements:

- Overview of main competitors

- Unique selling propositions and differentiators

- Strategies for gaining a competitive edge

- Objective: Show your understanding of the competitive landscape and your strategy to succeed against rivals.

Marketing and Sales Strategy

- Purpose: To detail how you plan to attract and retain customers and your tactics to achieve your sales goals.

- Key Elements:

- Marketing channels and promotional strategies

- Sales tactics and customer acquisition plans

- Unique approaches or partnerships

- Objective: Highlight your strategy for building a market presence and growing your customer base.

Operational Plan

- Purpose: To provide an overview of your business’s day-to-day operations, ensuring you have a robust plan for executing your business model.

- Key Elements:

- Key processes and operational workflows

- Facilities and technology requirements

- Management of operations

- Objective: Reassure investors that you have a solid plan for operational execution.

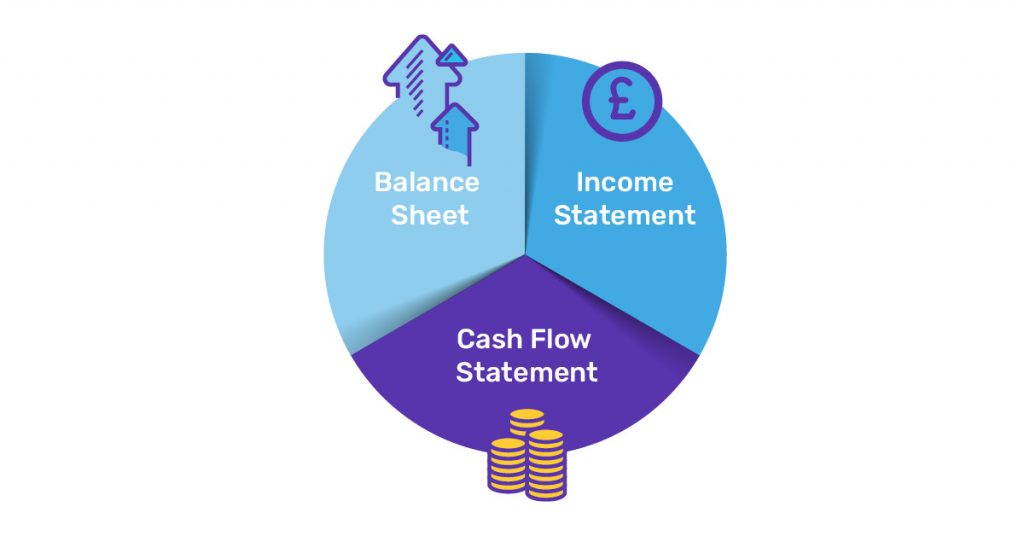

Financial Projections

- Purpose: To present detailed financial forecasts that show the expected financial performance of your business.

- Key Elements:

- Income statements, cash flow statements, and balance sheets

- Realistic projections based on market research and historical data

- Objective: Provide a clear picture of how your business will achieve profitability and manage financial growth.

Funding Requirements

- Purpose: To specify the amount of funding needed and how it will be used to achieve business objectives.

- Key Elements:

- Total funding required and allocation of funds

- Timeline for key milestones and funding utilisation

- Overview of funding strategy and potential returns on investment

- Objective: Clearly outline your funding needs and demonstrate how the investment will contribute to business success.

Customising for Different Investors

Investment Funds

When preparing to attract investment funds, providing a comprehensive overview that aligns with the fund’s investment criteria is crucial. Key aspects to emphasise include:

- Revenue Model:

- Clearly outline how your business will generate revenue.

- Detail the revenue streams, pricing strategy, and sales forecasts.

- Include projections and financial metrics that showcase profitability and financial health.

- Market Potential:

- Provide an in-depth analysis of the market size and growth opportunities.

- Highlight trends and data that demonstrate the scalability of your business.

- Show how your business fits within the market and its potential for capturing market share.

- Growth Strategies:

- Describe your strategies for scaling the business.

- Include plans for market expansion, product development, and strategic partnerships.

- Use data-driven projections to illustrate the expected return on investment (ROI).

Angel Investors

When approaching angel investors, focus on your business’s financial and emotional aspects. Key points to address include:

- Storytelling and Vision:

- Share the inspiring mission and vision behind your business.

- Explain how your business aligns with the values and interests of the angel investors.

- Use personal stories or impactful anecdotes to create an emotional connection.

- Mission Alignment:

- Demonstrate how your business’s mission aligns with the investor’s values and goals.

- Emphasise the positive impact your business aims to make and its societal benefits.

- Financial Returns:

- Present realistic financial projections and potential returns.

- Highlight the growth opportunities and financial metrics that support the investment’s viability.

Achieving the Right Length

A well-balanced business plan typically ranges from 8,000 to 10,000 words. This length is ideal for providing a thorough overview of all essential components, including market analysis, financial projections, and operational strategies, while still manageable for the reader.

A shorter business plan may suggest an overload of unnecessary details, which can detract from its clarity and impact. On the other hand, a too-brief plan may need to include critical information, leaving gaps that could undermine its effectiveness.

Therefore, it is crucial to strike a balance by ensuring the plan is detailed enough to cover critical aspects comprehensively yet concisely to maintain the reader’s interest. This approach helps in delivering a business plan that is both engaging and informative.

Conclusion

A well-crafted business plan is critical for attracting investor interest by presenting essential information clearly and engagingly. A streamlined and focused plan helps capture and maintain potential investors’ attention, making a solid and memorable impression.

The goal is not merely to provide a wealth of information but to offer a balanced view that sparks interest and invites further discussion. Your business plan should prioritise clarity, relevance, and strategic insight to achieve this. This means articulating your vision, strategies, and financial projections in a way that is both accessible and persuasive.

By emphasising these elements, you showcase your thorough preparation and address the investor’s need for a compelling and digestible proposal. This approach demonstrates your awareness of what investors value, increasing the chances of a successful pitch and potential funding.