Investor updates are not merely a courtesy but a powerful tool that strengthens relationships with investors, maintains transparency, and fosters trust. As founders, we must recognise that investors are partners in our journey. Regular communication with them is a foundation for continued financial and strategic support. Neglecting this aspect is a missed opportunity to leverage their expertise, resources, and networks.

Investor updates should not be viewed as an administrative burden but rather as a strategic asset keeping investors engaged, ensuring their ongoing commitment, and encouraging further investments. By fostering a consistent dialogue, we create a sense of alignment between the company’s progress and the expectations of its investors. This proactive approach reduces potential friction and allows us to demonstrate accountability, professionalism, and transparency.

Benefits of Regular Investor Updates

Regular updates to investors provide several critical advantages:

- Strengthening Investor Relationships

Open, consistent communication fosters trust and position us as dependable partners. This makes investors feel more confident in their decision to back our venture and primes them for future financial contributions. - Maintaining Investor Engagement

Keeping investors up to date with our progress ensures we remain top-of-mind. This is crucial when we need their immediate support for introductions, advice, or further capital investment. - Encouraging Additional Investments

Regular updates show investors the positive trajectory of our business, reinforcing their decision to invest and making them more likely to reinvest during subsequent rounds. - Leveraging Expertise

Investor updates are an excellent opportunity to solicit advice. Investors, many of whom have been founders, can offer valuable insights that we might not have considered, providing us with a competitive advantage. - Attracting Future Investors

Updates tailored for a broader audience can pique the interest of potential investors who previously passed on the opportunity. We can turn them into enthusiastic participants in upcoming funding rounds by showcasing our ongoing progress.

How Often Should You Send Investor Updates?

Monthly updates provide the optimal frequency for maintaining engagement without overwhelming investors. While it might be tempting to send updates more frequently, this can dilute their impact. Conversely, sending updates less often risks investors losing touch with the business. A well-crafted monthly update strikes the perfect balance, keeping investors informed without burdening them with excessive communication.

However, quarterly meetings, typically conducted via videoconferencing, offer an opportunity to examine the company’s performance more deeply. These meetings are essential for providing a comprehensive view of the business’s growth and future roadmap, fostering even more significant alignment with investors.

Critical Components of an Investor Update

Investor updates should be concise but comprehensive, offering enough detail to convey progress while respecting investors’ time. Below are the essential elements every update should include:

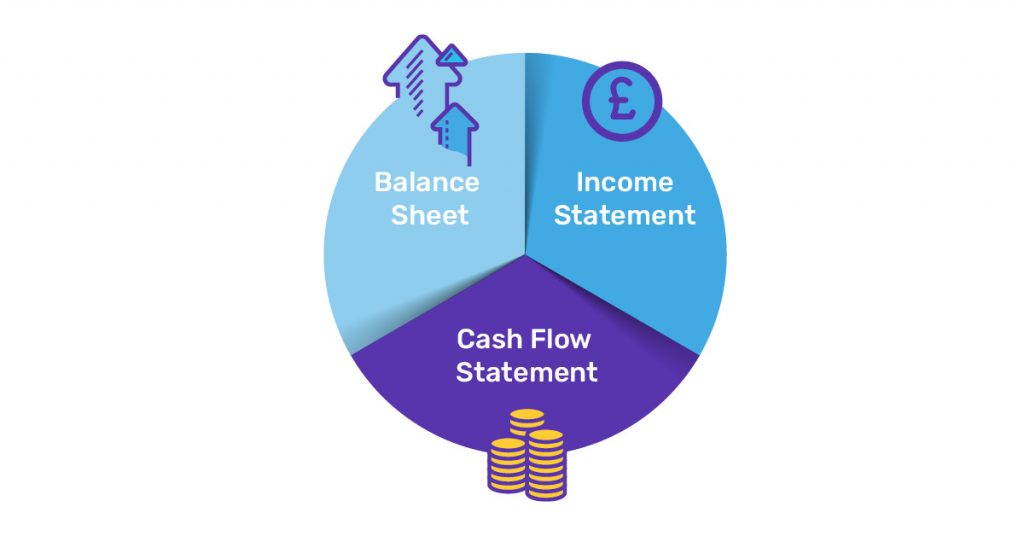

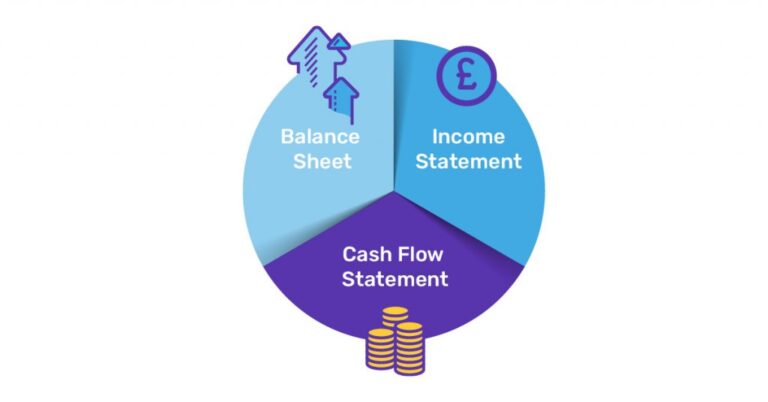

1. Performance Metrics

Investors are data-driven. Including high-level performance metrics provides them with a snapshot of how the business is performing. These metrics might include revenue, customer growth, user engagement, and burn rate. A brief analysis of these figures also offers context, helping investors understand the story behind the numbers.

2. Progress Towards Goals

Every update should include a review of the goals set in the previous month, detailing what has been accomplished, what is still in progress, and any obstacles encountered. This shows investors that we are making measurable progress and capable of identifying and addressing challenges.

3. Upcoming Goals

Clearly stating the objectives for the upcoming month helps investors understand where the business is heading and what areas require their support. This foresight demonstrates that we are focused on long-term growth rather than short-term fixes.

4. Key Business Developments

Updates should include major news, such as product launches, new partnerships, or significant hires. These milestones indicate that the business is evolving and making strategic moves to secure its future.

5. Requests for Assistance

Investors want to help beyond just providing capital. Whether it’s a need for introductions to potential clients, advice on market entry, or help with operational challenges, we should not hesitate to ask for their assistance. Investors appreciate founders who recognise the value they can bring beyond finances.

Honesty is Key: Reporting Both Good and Bad News

It’s essential to present both the successes and the challenges the business faces. Sugar-coating or avoiding negative news is a sure way to erode trust. Investors are seasoned professionals—they understand that not every month will be a victory. What matters is how we react to challenges, and whether we are proactive in addressing them. This candor builds credibility and ensures that our relationship with investors is built on a foundation of trust.

Quarterly Investor Meetings

In addition to monthly email updates, quarterly video meetings are invaluable. These sessions provide a broader view of the company’s trajectory, highlighting major accomplishments, ongoing initiatives, and long-term strategic goals.

The format for a quarterly meeting should closely mirror the monthly update, but with a 90-day perspective. This allows us to reinforce our vision, give investors a comprehensive overview of the business, and discuss upcoming funding needs. Limiting these meetings to 45 minutes ensures they remain productive and respectful of everyone’s time.

Insider Strategy: Transforming Investor Updates into Marketing Tools

Investor updates, with some adjustments, can be repurposed for wider distribution. By focusing solely on the positives and removing sensitive information, these updates can be shared with our broader network, including potential investors, partners, and supporters. This keeps them engaged with our progress and primes them for future collaboration or investment opportunities.

For example, a simplified version of the investor update can be sent to individuals who declined to invest in previous rounds. Staying in touch and showcasing progress may convert them into investors in future rounds.

Conclusion

Investor updates are an essential strategy for building and maintaining robust relationships with investors. They serve not only to inform but also to engage, fostering a sense of partnership and shared vision. Regular communication helps investors feel connected to the company’s journey, encouraging them to provide not just financial backing but also strategic support.

Moreover, transparent reporting—covering both successes and challenges—demonstrates accountability and builds credibility. This honesty is crucial for reinforcing trust, ensuring that investors are more likely to remain supportive during tough times. Additionally, well-crafted updates can stimulate interest from potential investors, expanding opportunities for future funding rounds.

In essence, proactive investor updates cultivate a collaborative atmosphere where both founders and investors can thrive, paving the way for sustained growth and success.