In 2025, choosing the right business model is critical for any startup’s success. Your business model defines how you create, deliver, and capture value. It’s not just a fancy buzzword. A business model answers the question, “How will we make money?” and shapes everything from pricing to operations.

Investopedia notes that a company’s business model “outlines what it will do to create and deliver value to customers, to generate profit.”. That means deciding on your value proposition, target market, revenue streams, cost structure, etc. A strong business model connects all these pieces so your startup can grow sustainably.

A well-crafted startup business plan incorporates this model into a complete roadmap. It lays out objectives, market analysis, and finances. For example, IndiaFilings explains that a startup business plan “identifies the products or services the business plans to sell, the target market, and any anticipated expenses… to outline how to generate a profit.”

In short, a startup’s business plan is its blueprint: it aligns the team, guides strategy, and attracts investors. Without it, founders often run out of money or fail to pivot in time. As one entrepreneur survey found, nearly half of failed startups cited a lack of a strong business plan and running out of cash.

In the sections below, we’ll unpack what a business model means, how it differs from the operating model, standard model types for 2025 (with examples), and how to build and test your model. We’ll also cover India-specific considerations from legal registration to funding.

What Is a Business Model (And Why It’s Not Just a Fancy Term)?

A business model is essentially your startup’s game plan for making money. It describes what you offer, who you sell to, and how you get paid, all tied together into a strategy. Investopedia defines it as “a plan that outlines what [a company] will do to create and deliver value to customers, to generate profit.” Think of it as a blueprint: it specifies your value proposition (why customers should buy), customer segments (who you’re selling to), channels (how you reach them), revenue streams (how you charge money), key resources/activities (what’s needed to deliver), and cost structure (your expenses).

A clearly defined business model helps align the team and investors around a shared vision. As one startup guide puts it, a business plan (which contains the model) “helps clarify your vision, anticipate potential challenges, identify resources, and assess market feasibility” before you even launch. It’s a roadmap for growth. For entrepreneurs, having no plan or a vague model is risky, as it often leads to running out of cash. One survey of 150 founders found that running out of money or having no clear business model were among the top reasons startups folded. By contrast, revenue (proof that people pay for your value) is the ultimate metric of product-market fit.

In summary, a business model is not just industry jargon. It’s the backbone of your startup’s strategy: it guides pricing, marketing, product development, and operations. By defining how you’ll create and capture value, your business model sets the stage for everything that follows.

Business Model vs Operating Model: Know the Difference

Startups sometimes confuse a business model with an operating model, but they are distinct. The business model is your strategic blueprint, describing what you do and why it creates value (and revenue). The operating model is the execution plan, explaining how you organise people, processes, and technology to deliver that value.

- Business Model: Think of this as the strategy. It includes your value proposition (the problem you solve), target customers, revenue streams, cost structure, and competitive advantage. For example, a SaaS business model might be “provide an online design tool via monthly subscription.” This defines what you offer and how you charge.

- Operating Model: This is the implementation. It describes how the business model is brought to life. It covers your organisational structure, workflows, and technology. For instance, in the SaaS example, the operating model details the software development team, cloud infrastructure, customer support, and marketing processes needed to deliver that online tool and support subscribers.

Put another way, the business model answers “What problem are we solving, for whom, and how do we earn?” while the operating model answers “How do we run the business day-to-day to deliver that?”. In practice, they must align. A pivot in your business model often requires tweaking your operating model (new processes or tech).

For example, shifting from one-time sales to a subscription revenue stream means adding billing and recurring customer service processes to the operating model. Accelare notes that you must adjust your operations accordingly when you change strategic elements (like revenue streams).

Ultimately, both models matter. You need a solid business model to define your startup’s direction and scalability and a robust operating model so your idea works. Neglecting either can stall growth.

Why Startups Fail: Lessons in Choosing the Right Model

Picking the wrong business model (or ignoring it altogether) is a common reason startups collapse. Many early ventures shut down in India and worldwide due to cash flow issues, often rooted in a flawed model or strategy.

For example, a December 2024 report noted that over 5,000 Indian startups closed in 2024. Causes ranged from funding gaps and regulatory hurdles to market saturation and wrong assumptions. Globally, surveys of founders echo this: the top failure reasons are running out of money and lacking a viable business model.

A model that doesn’t fit the market means no one pays. CB Insights famously found “no market need” was the number-one cause of failure. In such cases, no investment saves a startup. As one founder bluntly put it, more funding won’t fix it if people won’t pay for your solution.

Generating revenue is often the best proof you’re on the right track. The Wilbur Labs survey quotes former Google CEO Eric Schmidt: “Revenue solves all known problems.” Startups that show even small profits or revenue have demonstrated customer demand.

Key lessons: Plan and test your model early. Assemble a business plan that lays out your model, market analysis, and financial roadmap. Seek evidence (customer interviews, prototype sales) before going all-in.

Remain ready to pivot: If your initial model doesn’t work, refine your offering or pivot to a new segment. Interestingly, 40% of startups avoid failure by rotating based on early feedback. In short, an adaptable business model approach is used to prevent a rigid plan.

Some specific pitfalls to watch for:

- Too many costs, too little revenue: Businesses with high fixed costs (manufacturing, salaries, etc.) but uncertain revenue often fail first. Make sure your revenue streams can at least cover expenses.

- Ignoring customer discovery: If you assume the problem or price without talking to users, you risk building something nobody buys. Lean methods (test with early adopters) help catch this.

- Wrong pricing model: Picking a model (e.g. one-time payment vs subscription) that customers won’t accept can kill a product. For instance, enterprise buyers might reject a fixed price if they prefer pay-per-use flexibility.

- Scaling prematurely: Growth is tempting, but expanding too fast with a weak model can exhaust funds. Nail profitability or a clear path to it first.

By learning these lessons, focusing on revenue, testing assumptions, and ensuring your model aligns with real demand, founders significantly improve their odds of success.

What Are the Business Models: Core Types in 2025

Many successful startups use clearly defined models. Below are some of the most popular and effective models for 2025, with real-world examples:

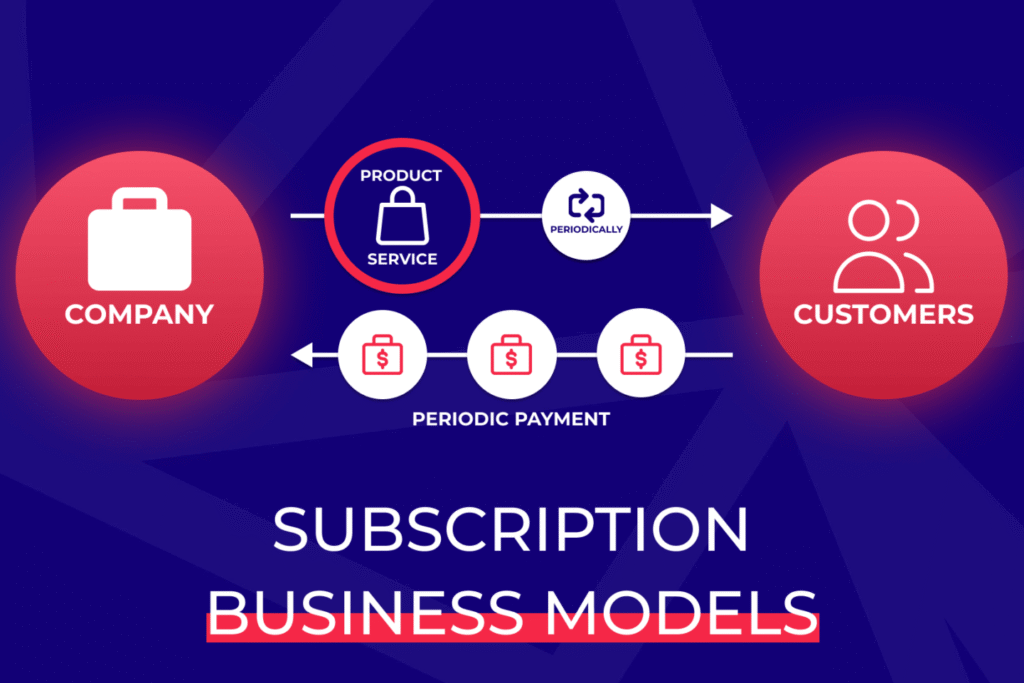

1. Subscription-Based Model

A subscription model charges customers a recurring fee (monthly, quarterly or yearly) to access a product or service. This creates predictable, recurring revenue and long-term customer relationships. It’s very common for digital services and SaaS.

For example, Netflix and Spotify charge monthly for streaming content, while many online learning platforms (IIDE’s courses, Coursera) and SaaS tools (e.g. Zoho, Microsoft 365) use subscriptions. The significant advantages are stability and customer loyalty. However, it demands constant value delivery; customers will churn if they don’t feel they’re getting their money’s worth.

This model suits startups like media platforms, software products, and D2C companies offering subscription boxes or memberships.

2. Freemium Model

The freemium model offers a basic product version for free and charges for premium features. It’s a way to build a large user base quickly by lowering the barrier to entry, then converting a percentage into paying customers.

Notable examples include Slack (free basic chat, paid upgrades) and Dropbox or Google Drive (free storage, paid extra). Even Indian startups use freemium tools like Lio (business app) or News18, which offer free content with premium tiers. Freemium is great for apps and software (especially B2B SaaS) that can support free users at scale.

However, conversion rates are typically low (often 25%), so costs must be managed carefully. The trick is to give enough in the free tier to attract users, but make the premium tiers compelling.

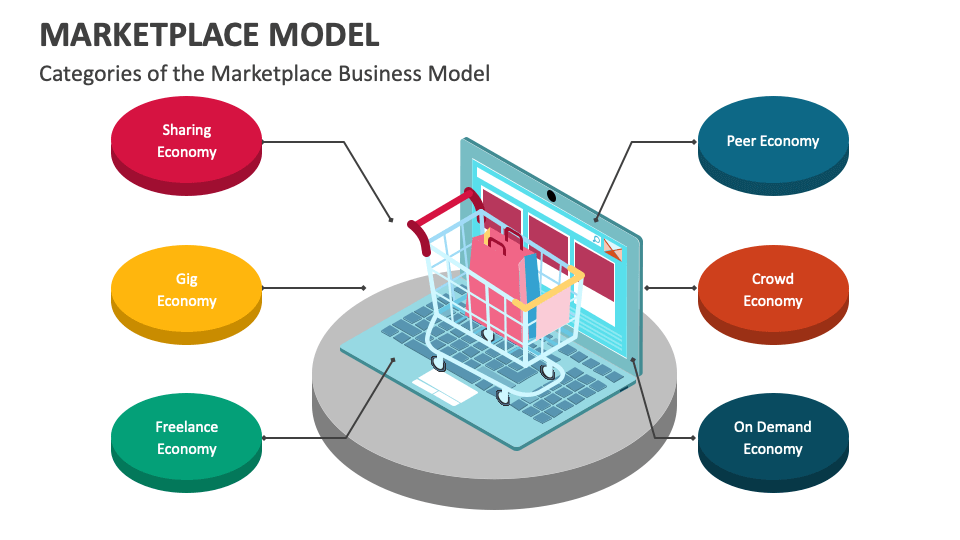

3. Marketplace Model

A marketplace model connects buyers and sellers, often paying each transaction a commission or fee. Think of it as a platform that facilitates exchange. For instance, Amazon and Flipkart started as e-commerce marketplaces where multiple vendors sell goods, and the platform takes a cut. In India, companies like Swiggy and Zomato are In-run marketplaces that connect restaurants with hungry customers, charging restaurants a commission on every order.

Likewise, ride-hailing apps like Uber or Ola are marketplaces matching riders to drivers (they charge a commission per ride). The marketplace model’s strength is scalability: the startup doesn’t hold inventory but leverages others’ supply.

However, it relies on attracting both sides (good sellers/partners and paying customers) and is often capital-intensive to gain liquidity and trust.

4. On-Demand Model

The on-demand model offers instant access to products or services via a platform, capitalising on consumers’ desire for speed and convenience. It’s a close cousin of the marketplace but emphasises immediacy (often delivery within minutes or hours).

Common on-demand examples are transportation (Uber, Ola), food delivery (Swiggy, Zomato), and local services (Urban Company for home repairs, Dunzo for errands). The defining feature is that customers immediately fulfil their needs with just a few taps on an app. This model is booming: global on-demand app revenue is projected to surge (one estimate puts it at ~$335 billion by 2025).

For startups, on-demand solutions are effective when there is a clear, urgent problem to solve with technology. It often requires logistics operations (drivers, inventory, or partners ready to fulfil requests) and a strong app interface.

In India, on-demand services are huge; consider the popularity of quick-commerce apps, ride-hailing services, and even on-demand grocery services (like BigBasket) or courier services.

On-demand model examples include apps that provide immediate services like ride-hailing. Smartphone interfaces enable customers to quickly request and receive services.

5. D2C (Direct-to-Consumer) Model

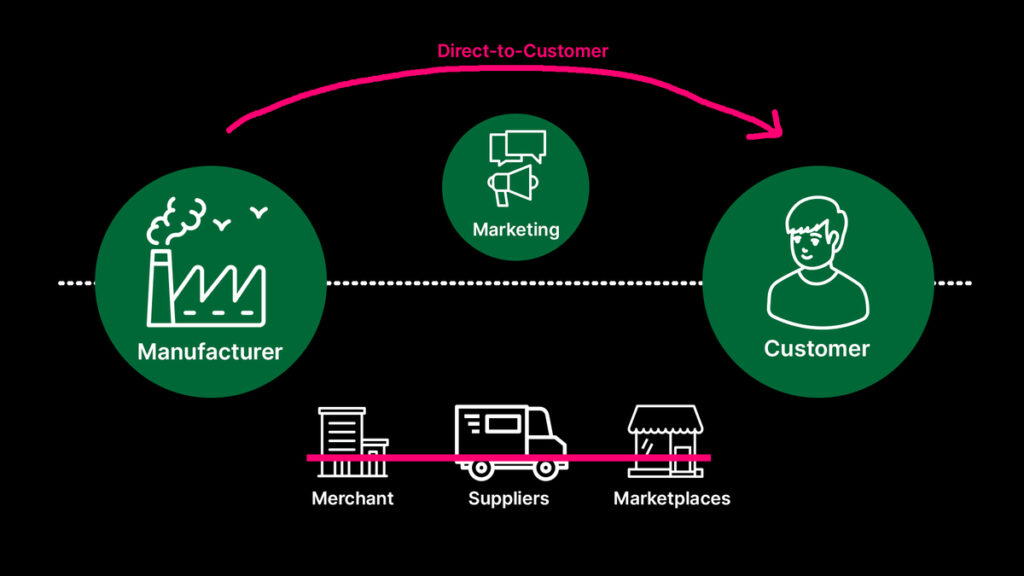

The Direct-to-Consumer (D2C) model means the startup manufactures or sources products and sells directly to customers, cutting out intermediaries. This has been growing fast with the rise of e-commerce in India. Notable Indian D2C brands include Mamaearth (beauty products), boAt (consumer electronics), and Lenskart (eyewear).

D2C startups control their entire brand and customer experience, which can lead to higher margins and strong customer loyalty. For example, producing their products allowed Mamaearth to capture a large share of the personal care market by selling directly via their website and Amazon.

The trade-off is inventory risk: D2C companies often need significant capital for production, warehousing, and marketing before turning a profit. As Founderlabs points out, D2C/Manufacturing models offer “full control over quality and branding” and “higher margins” but require working capital and time to scale. In 2025, many new D2C brands (especially in fashion, electronics, and FMCG) are emerging by leveraging social media and online marketplaces to reach customers directly.

6. SaaS Model (Software as a Service)

SaaS is a subtype of subscription model focused on software. Here, the startup provides cloud-based software users access online (often through a browser or app) for a recurring fee. SaaS is attractive to startups because it avoids piracy, and upselling/upgrading is easy. Zoho (India’s famous SaaS suite) and Freshworks (customer support software) exemplify this model. Investors love SaaS for the predictable revenue and high margins. In 2025, AI-powered SaaS tools (content generators, analytics platforms, CRM, etc.) are especially hot. These tools often use a combination of free trials (or freemium) and subscription upsells. For example, a new Indian startup might offer an AI content editor: a free tier with basic usage and paid plans for higher word limits and team features. Zoho recently reported a ₹2,836 crore profit, showing how profitable SaaS companies can be. The key to SaaS success is keeping churn low (customers don’t cancel) by continually updating and improving the software.

7. Aggregator Model

An aggregator model is similar to a marketplace but with more control over the end-to-end experience. In an aggregator, the startup’s brand is front and centre, and it typically sets quality standards for suppliers. Classic examples include Uber (aggregates independent drivers under the “Uber” brand) and Airbnb (aggregates homeowners under one platform). Indian examples are OYO (aggregates and standardises budget hotel rooms) and CureFit (aggregates fitness instructors under its own fitness centres or app). The aggregator model often involves owning the customer relationship tightly and providing standardised service. For startups, an aggregator can scale quickly by recruiting partners (drivers, sellers, service providers) and giving them the brand’s technology and processes. The downside is aggregators often need heavy investment to ensure supply and maintain standards. The line between marketplace and aggregator frequently blurs, but think of aggregators as platforms that feel like one company, whereas pure marketplaces may let sellers keep their brand.

8. Licensing Model

A licensing model involves selling the right to use your intellectual property (IP), technology, or content to other businesses or entrepreneurs. Instead of selling a product, you license it for a fee. For example, a biotech startup might license a patented drug formula to a pharmaceutical company, or a software startup might license its AI algorithm to enterprises. Even cartoon characters or designs can be licensed to manufacturers. This model can yield high margins since development costs are already sunk; each licensee pays to use the innovation. It’s common in biotech, patent-heavy fields, and content/IP businesses. A real-world Indian analogy: a startup with a patented agricultural technology could license it to large agribusinesses. The licensing model is low-cost to scale (once the IP is developed, additional licenses cost little) but hinges on strong protection of that IP. It also may require a long sales cycle (partners need confidence before paying hefty license fees).

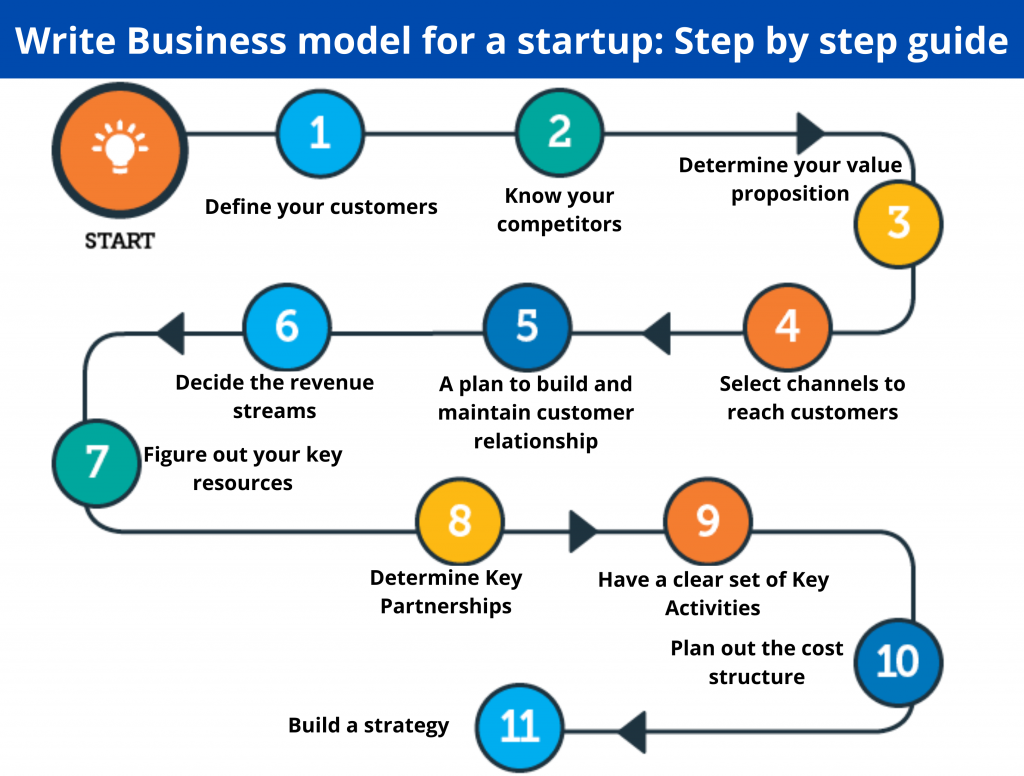

How to Make a Business Model for a Startup (Step-by-Step Guide)

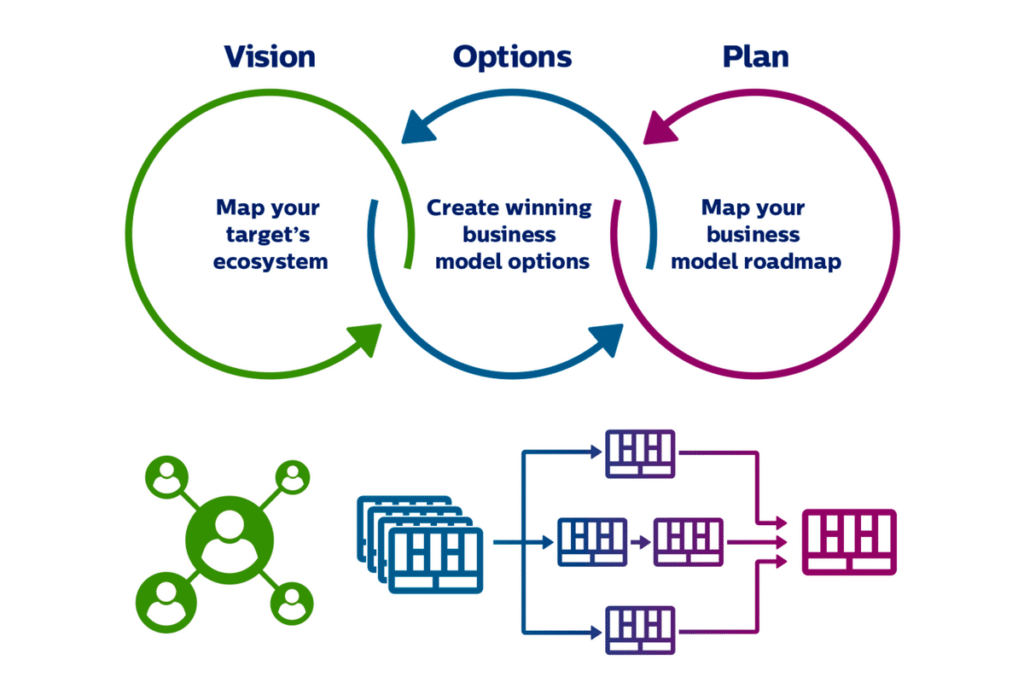

Designing your startup’s business model is an iterative process. Here’s a practical step-by-step approach:

- Step 1: Define the Problem You’re Solving. Start by clearly articulating the core problem or need your startup addresses. Is it saving time, lowering cost, or improving quality? For instance, if launching an AI content writing tool, the problem might be that “Small businesses lack quick, affordable marketing content.” A clear problem statement keeps you focused on value. Talk to potential users or conduct surveys to ensure it’s a high-priority problem for them. Without a real problem, your business model won’t have a market.

- Step 2: Identify Your Target Customer. Determine who has this problem explicitly and will pay for the solution. Segment your customers by demographics, industry, company size, etc. For the content tool example, target customers could be marketing teams at startups, social media agencies, or freelance bloggers. Understanding the customer guides your product features, branding, and pricing. Create a customer persona (or two) and keep them in mind. As you refine the model, ask, “Why would this customer choose us?”

- Step 3: Choose the Right Revenue Stream. Decide how you will charge. Will it be one-time sales, subscriptions, commissions, ad revenue, or something else? This should align with the problem and the customer. Subscriptions work well if ongoing value is delivered (e.g., software). Commission models fit multi-sided platforms. For example, if building a SaaS content tool, you might pick a freemium/subscription model: a free basic plan and paid tiers. If instead it’s a marketplace for freelance writers, a commission or service fee per article might be best. Sketch out prices or fees and estimate revenue per user. Ask yourself if it’s a price point your target customer can afford.

- Step 4: Draft a Lean Business Model Canvas. Put it all on one page using a framework like the Lean Canvas or Business Model Canvas. List key elements: Value Proposition (what you offer), Customer Segments, Channels (how you reach them), Customer Relationships, Revenue Streams, Key Activities, Key Resources, Key Partners, and Cost Structure. For example, under Key Activities, you might list “develop AI model, marketing, customer support.” Under Key Partnerships, it may be “cloud provider, content writers.” Mapping this out helps you spot gaps and see the big picture; drafting forces you to clarify assumptions (e.g. user acquisition costs, partner needs). You can find templates for a Lean Canvas online (Ash Maurya’s Lean Canvas is popular).

- Step 5: Validate with Real Users. Before fully launching, test your business model with real customers. Build a minimum viable version of your product or service and try to make a sale or sign up. Collect feedback on pricing, features, and value. For example, offer a beta of your AI writing tool to a handful of customers at a discounted rate or for feedback. Do interviews to ensure the problem is real and your solution is acceptable. This crucial step tells you if people will pay under your model. According to startup research, early revenue and customer traction are the most substantial proof of product-market fit. Use these insights to tweak your model, perhaps adjusting pricing, shifting target segments, or adding features. Iterate quickly: a startup’s business model should evolve until it works.

Following these steps gives you a lean, testable business model. As Wilbur Labs’ survey advises, founders who frequently update their business plan and model based on data avoid failure. You’re on firmer ground to build and scale with a validated model.

Business Model vs Operating Model: What You Need to Know

We’ve already covered the theory of business model vs operating model. Here are the practical key takeaways to remember:

- Strategic focus vs execution: Your business model is about strategy, the value proposition, revenue logic, and market positioning. It answers “What do we do?” and “How do we earn?” Your operating model is about operations, the processes, team structure, and technology that execute that strategy. In practice, ensure your operations are designed to deliver your promised value. For example, if your model promises 24/7 service, your operating model must include support staff or automated systems.

- Components: If we list them, a business model includes elements like target customer, value proposition, revenue streams, and cost. The operating model contains an organisation chart, core processes, IT systems, and standard operating procedures. Think of the business model as a plan, and the operating model as the machines making that plan run.

- Innovation vs. implementation: The business model is where you can innovate, finding new niches, technology, or revenue ideas to gain an edge. The operating model is where you focus on efficient implementation, refining workflows, automating tasks, and improving productivity. Both need attention: A brilliant business model can fail if the operating model is chaotic (e.g., delivery delays, poor customer service). Conversely, significant operations won’t save a bad model.

- Adapt and align: When you change your business model, be ready to adapt your operating model. If you introduce a new product line or shift pricing, update processes accordingly. The Accelare guide emphasises that one shift often requires changes in the other. For startups, this might mean hiring different expertise, integrating new tools, or restructuring teams as they evolve. Ensure continuous communication between strategy and execution teams.

In essence, these two models should always be kept in sync. Know what you’re selling (business model) and ensure you have a concrete plan for how you’ll deliver it (operating model).

Business Plan for Startups in India (2025 Specifics)

For Indian entrepreneurs, crafting a business plan for a startup in India involves some unique considerations. Aside from market strategy, you must handle legal, regulatory, and financial specifics:

Legal Registrations

Choose the proper business structure. In India, common choices are Sole Proprietorship, Partnership, Limited Liability Partnership (LLP), or Private Limited Company. Each has different liability and compliance implications. For example, a Pvt Ltd limits founders’ liability but requires minimum share capital and filings; an LLP is easier to start but may be less preferred by investors. Decide based on scale, number of founders, and plans.

Once chosen, register your company. This means obtaining a PAN (Permanent Account Number) and TAN (for tax deduction) from the Income Tax Department, and GSTIN (GST Registration) from the Goods & Services Tax authorities if your turnover may exceed ₹20 lakh (or the state threshold). Also, register with the appropriate authorities (e.g., MSME’s Udyam Registration can help you get loans). You’ll need PF (Provident Fund) and ESIC registrations if you hire employees. And don’t forget any industry-specific licenses (like FSSAI for food, or a shop’s/establishment license).

Importantly, check Startup India recognition. After incorporating, you can apply to the DPIIT (Department for Promotion of Industry and Internal Trade) to be a recognised startup. This is free and once granted, it unlocks certain benefits (see below). But it also certifies to banks and investors that you’re a “formal startup.”

In short, the business plan for a startup in India should outline your legal entity and list required registrations (company/LLP registration, PAN/TAN, GSTIN, etc.). Compliance is non-negotiable; a well-regulated startup is more attractive to investors and partners.

Tax Benefits and Startup India Scheme

The Indian government offers tax incentives and other perks to encourage startups. DPIIT-recognised startups can apply for an income tax exemption under Section 80-IAC. This grants a 100% tax deduction for three consecutive years out of the first ten years of operation. In practice, if your startup turns a profit, you pay no income tax on it for three years. (There are conditions: you must be under 10 years old, have paid-up capital under ₹10 crore, and produce an innovative product.)

Another benefit is under Section 56, which exempts specific funding from taxation. Essentially, funds raised by an investor in your startup (like equity investment) are not treated as taxable income up to prescribed limits. The Startup India initiative also offers intellectual property support: for example, startups get an 80% rebate on patent filing fees and fast-tracking of patent examination, which can save time and money if you have proprietary tech.

On the regulatory side, Startup India allows self-certification of labour and environmental law compliance for up to 5 years ( years), reducing inspections. It also simplifies winding up: startups can wind up within 90 days if needed.

In summary, your business plan for a startup in India should mention these schemes and tax incentives. Highlight that you plan to register under Startup India to leverage tax holidays and legal relaxations. Doing so can improve your financial projections and reassure investors that you will retain more capital for growth.

Funding and Pitching Landscape

The funding environment in India has been volatile in recent years. After a slowdown in 20222023, early 2025 has shown signs of revival (India’s tech startups raised several billion dollars in Q1 2025, a significant increase year-over-year*). Still, competition for capital is intense, and investors are more focused on unit economics and sustainability than ever.

Investor pitch: Emphasize your business model clearly. Indian VCs and angels will want a solid go-to-market plan, traction metrics (users/revenue), and a clear path to profitability. They often ask for the Total Addressable Market (TAM) to gauge potential scale. For a startup in India, explain local nuances in your plan: will you start in one city or pan-India? How will you acquire customers affordably in a price-sensitive market?

Sources of funding: Besides private VC/angel, Indian startups can tap into government schemes. The Startup India Seed Fund Scheme (via SIDBI) grants up to ₹20 lakhs for early-stage startups in specific sectors. There’s also a fund-of-funds (managed by SBI Capital) that co-invests with selected VCs in startups. Many state governments have their seed funds. Including this in your plan shows you’ve considered all avenues.

Pitching: Networking is key. Incubators (T-Hub, NASSCOM 10,000 Startups, etc.) and startup events can help you practice your pitch. In 2025, investors will value clear unit economics, such as Customer Acquisition Cost vs Lifetime Value. Use bullet points or slides in your pitch to show: problem, solution (your value prop), model (how you make money), traction (users/revenue if any), team, and financial projections. Think from the investor’s viewpoint: “How quickly will I get my money back, and what growth can I expect?”

Overall, the Indian funding landscape rewards startups with solid planning and a viable model. Your business plan for a startup in India should address how much you need, why, and how you will use it to achieve milestones. Mention any bootstrap funds or initial revenue to show commitment and seriousness.

Which Startups Are Most Profitable in 2025?

Looking at current trends, some startup verticals stand out for high profitability or growth potential. In India, companies leveraging technology and scalable models have delivered substantial profits. For example:

- AI-Powered Tools & SaaS: Artificial intelligence continues to reshape software. Startups building AI-based SaaS platforms (like Zoho’s suite) generate recurring revenue. Zoho Corporation, an early SaaS pioneer, recently reported an after-tax profit of around ₹2,836 crore. This highlights that AI-driven software (content writing tools, analytics, sales automation, etc.) can yield significant margins once product-market fit is achieved. Entrepreneurs should look at needs in marketing automation, enterprise productivity, or specialised AI services.

- Sustainable/Green Startups: Clean tech and sustainability are on the rise. Renewable energy, electric vehicles, and sustainable products often receive policy support and growing demand. For instance, Renew Power (a renewable energy firm) profited about ₹782 crore.co, showing the appetite for green businesses. In India, opportunities exist in solar rooftop installations, waste recycling technologies, and eco-friendly consumer goods. These areas meet social goals and can be profitable as regulations and consumer preferences favour green solutions.

- Fintech and Digital Finance: Fintech remains a hot sector. Indian online brokerage and lending startups have posted huge profits. Zerodha (a discount brokerage platform) earned a staggering ₹5,496 crore in profit recently. Five-Star Business Finance (a small-business lending NBFC) posted ₹836 crore profit. These examples show that financial services startups can scale massively, from payments to wealth tech. With India’s large unbanked population and growing digital economy, fintech models like digital lending (with proper risk management), insurance tech, payments, and B2B financial platforms (like OfBusiness with ₹603 Cr profit blog.privatecircle.co) are lucrative.

Other sectors gaining traction include education tech (upskilling platforms), health tech, and e-commerce aggregators. The common thread is high demand and scalable distribution. However, profitability depends on execution, so the most profitable startups pair a solid business model with operational discipline.

Business Plan for Startup Example

Example: AI-Based Content Writing SaaS (“WriteBot”)

Let’s walk through a sample business plan scenario for an Indian startup called WriteBot, an AI-powered content-writing SaaS for small businesses:

- Problem: Small businesses and digital marketers need lots of content (blogs, ads, social posts) but lack time or writing expertise. Hiring writers is expensive and slow.

- Solution & Model: WriteBot offers an online AI writing assistant. Users can generate articles or marketing copy in minutes by inputting prompts. The platform uses advanced AI to ensure quality. The revenue model is subscription: a free basic tier (limited outputs per month) and premium plans (unlimited content, API access, team accounts).

- Target Customer: Indian SMBs, bloggers, and digital agencies who need regular content. They are tech-savvy but budget-conscious, so a low monthly fee (e.g. ₹499₹2999) suits them. Early adopters might be e-commerce store owners and local startups.

- Channels: Go-to-market via digital marketing (Google/Facebook ads targeting business owners), content marketing (WriteBot’s blog showing sample outputs), and partnerships (affiliate deals with web hosting or CMS platforms). The founding team could also leverage contacts at coworking spaces to onboard first users.

- Value Proposition: “WriteBot produces SEO-optimised content 10x faster than a writer, at a fraction of the cost.” Testimonials from early users show it saves them hours per week.

- Key Activities/Operations: Develop and maintain the AI engine (cloud infrastructure for NLP models), build the web app, and run customer support. The team would include AI/ML engineers, a product manager, and a content marketing specialist. Key partnerships might be with cloud providers (for computing power) and publishers (to integrate an editor).

- Cost Structure: Cloud computing (AI models require GPUs), developer salaries, and marketing spend are significant costs. These are mostly fixed/substantial upfront costs.

- Revenue Projections: StartBot projects 500 paid subscribers by year 1-end at an average of ₹2,000/month, growing to 5,000 by year 2. This initially yields a monthly MRR (monthly recurring revenue) of ₹10 lakh, scaling to ₹1 crore+ in two years. They also plan an enterprise license for large agencies.

- Validation: WriteBot would share a demo with 10 prospective customers before launch and lock in a small signup fee for beta access. Their pilots confirmed businesses would pay ₹5001000 for quality content. This feedback refined their pricing and feature roadmap.

- Financials: The initial investment needed is ₹20 lakhs (for development and marketing in year 1). The break-even point is expected in 18 months. The projections include profit/loss and cash flow, assuming some subscription churn.

This example shows how a startup might outline its business plan components: problem, solution, target market, model, and basic finances. For a business plan for a startup in India like WriteBot, it’s crucial to factor in local context (e.g., pricing in INR, GST on services, Hindi language support later) and highlight the use of government schemes or incentives if relevant. But at its core, the plan ties the startup’s business plan to a viable model and roadmap.

Visualising a startup business plan: a structured checklist helps cover all key sections.

Final Thoughts

Building a startup in 2025 means thoughtfully choosing and executing your business model. There’s no one-size-fits-all answer; the best model depends on your industry, customers, and resources. However, a few principles hold:

- Customer at the centre: Always validate that your model solves a real pain point. As Wilbur Labs found, revenue is the ultimate proof of fit. If people aren’t willing to pay, reconsider your approach.

- Flexibility: Don’t be afraid to pivot your model if needed. Many successful founders experimented and refined their strategy over time. Build your business plan as a living document that evolves with feedback.

- Combine models: Hybrid models can work. For example, an edtech startup might use a freemium + subscription approach, or a D2C brand could add subscription boxes to its direct sales. The key is coherence. Each revenue stream should reinforce your core value proposition.

For Indian entrepreneurs, leverage the ecosystem: Register under Startup India to ease your journey, and highlight this in your plan. Craft a detailed business plan and model; this is more than a school exercise; it’s how you map out success. Use local examples as inspiration (like India’s profitable SaaS and D2C startups), but think globally in scale.

Ultimately, the best business model is one that customers embrace and your team can reliably execute. Be thorough in planning, yet lean in testing. With the right model and persistent execution, your startup can take off in 2025.